![]() Podcast 738 episodes

Podcast 738 episodes

Equity Mates Investing Podcast

Back in 2017, Bryce and Ren (otherwise known as Alec), found themselves at the beginning of their investing journey. They wanted to learn more, and educate themselves about stocks, the market, and understand what all those jargon words mean. They were daunted about starting, but thought why not document the journey the whole way on a podcast.

Today, Equity Mates is Australia’s best investing podcast for millennials. Twice a week, Bryce and Alec will take you from beginning to dividend, chat to leading experts, and CEOs of companies they respect and admire.

Join our community of Equity Mates, and start your journey now!

Listen On

Experts Interviews

Hear from the best investing experts from around the world

Yesterday

Expert: Cameron Blanks - Secrets of Australasia's largest private equity fund | Pacific Equity Partners

Sponsored by Pacific Equity Partners

4 days ago

Expert: Roger Montgomery - 5 stocks he's buying today

11th Apr, 2024

Expert: Joe Wright - Three ways to invest in resources | Airlie Funds Management

Sponsored by Airlie Funds Management

1st Apr, 2024

Expert: Sam Gordon - Rentvesting, Equity Recycling & what is going on with Aussie property?

28th Mar, 2024

Expert: Ben McVicar & Jowell Amores - Infrastructure: Invest in where the world is going

Sponsored by Magellan Asset Management

Uncovered

Every company has a story worth telling

18th Apr, 2024

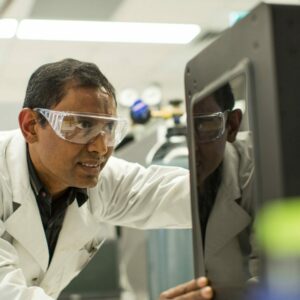

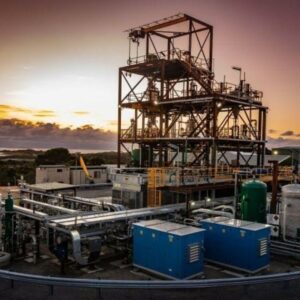

Uncovered: Hazer Group - A new way to make clean hydrogen

Sponsored by Hazer Group

Episodes

-

General

GeneralExpert: Cameron Blanks - Secrets of Australasia's largest private equity fund | Pacific Equity Partners

Today we speak to Cameron Blanks from Australasia's largest private equity player, Pacific Equity Partners, about the success of the asset class and hear about how they are trying to make it that little bit more accessible. 26 April

26 AprilSponsored by Pacific Equity Partners

-

Industry Deep Dive: Sports Betting - 5 years after legalisation in the US, who is winning?

In 2018, the US Supreme Court ruled that the federal ban on sports betting was unconstitutional. That sparked a frenzy of activity as companies from around the world tried to capitalise on the opportunity. 25 April

25 April -

Expert: Roger Montgomery - 5 stocks he's buying today

On today's podcast Roger Montgomery unpacks his current view on the market and shares a number of stocks he's buying at the moment. 23 April

23 April -

We're celebrating 1,000 episodes!

In this episode we take a moment and reflect on the past 7 years. We discuss how we started, the milestones along the way and get into the business behind the podcasts. 22 April

22 April -

General

GeneralUncovered: Hazer Group - A new way to make clean hydrogen

Today, the global market for hydrogen is valued at over $150 billion and it is only expected to grow as an important fuel in the world's energy transition. 19 April

19 AprilSponsored by Hazer Group

-

General

GeneralAdam Dawes joins for Pimp my Portfolio, TikTok's worst advice pt.2 & meet Channel 10's new (potential) owner

Pimp my Portfolio has fast become one of our favourite segments here at Equity Mates. In this episodes, Grant has submitted his portfolio to be reviewed by Adam Dawes of Shaw & Partners. 18 April

18 April -

General

GeneralLive: Ask an Advisor with Glen Hare - Property, Superannuation, Brokers, Insurance & more

In this recording of our Sydney live show, we opened up our Ask an Advisor format and gave you the chance to ask your most pressing financial questions. 16 April

16 April -

General

GeneralAustralia's Dividend Darlings, don't expect rate cuts soon & where we find information

The United States has the Dividend Aristocrats - a group of companies in the S&P 500 that have raised their dividend for 25 years or more. But we don't have an equivalent here in Australia - until now. 15 April

15 April -

General

GeneralExpert: Joe Wright - Three ways to invest in resources | Airlie Funds Management

The old stock market adage tell us that 'Australia is a land of banks and miners'. But beyond the big 3 miners, there are plenty of interesting companies in the resources sector. 12 April

12 AprilSponsored by Airlie Funds Management

-

TikTok's worst financial advice, Pimp my Portfolio & the pros and cons of music royalties

This asset class has become more accessible for everyday investors with companies listed on the stock market. But just because we can invest in music royalties, doesn't mean we should. We unpack why in today's episode. 11 April

11 April -

General

GeneralBuy or Sell with Adam Keily and Adam Dawes

In today's episode, Adam Keily is joined by Adam Dawes of Shaw & Partners. Do you have a stock you want to ask about? Hit us up via our website. 9 April

9 April -

General

GeneralMove over Magnificent 7, meet the Magnificent 11, Bryce’s small cap investment & Compounding continued

You've probably heard of America's Magnificent 7 - Nvidia, Apple, Microsoft, Alphabet (Google), Tesla, Amazon and Meta (Facebook). In this episode we introduce you to the latest grouping of stocks to watch - the Magnificent 11. 8 April

8 April -

General

GeneralA Truth Social conspiracy, Pimp my Portfolio & the business of Champagne

In the past month, both Truth Social and Reddit have listed on the stock market. We compare the pair and ask what next for Donald Trump's social media company. 4 April

4 April -

Expert: Sam Gordon - Rentvesting, Equity Recycling & what is going on with Aussie property?

There is always plenty going on in the Australian property market. And when we want to get an update on what is going on, there is one person we turn to: Sam Gordon of Australian Property Scout. 2 April

2 April -

Lump sum or DCA, the latest on Ozempic & a baby Berkshire?

Haven't heard much about Ozempic lately? Let us change that and bring you up to speed on some wild developments in the world of weight loss drugs. 1 April

1 April -

General

GeneralExpert: Ben McVicar & Jowell Amores - Infrastructure: Invest in where the world is going

Infrastructure has been an incredible asset class for investors over the past few decades. But the asset class has come a long way from Warren Buffett’s famous adage, ‘the best investment is the only bridge into town’. 29 March

29 MarchSponsored by Magellan Asset Management

-

General

GeneralSuper-for-Housing 🤮, Pimp my Portfolio 💰 & investing in India 🇮🇳

The Federal opposition has proposed allowing Australians to access their superannuation to buy their first home. Good idea or bad idea? We unpack in today's episode. 28 March

28 March -

General

GeneralAsk an Advisor: Glen Hare - The most common questions Aussies are asking advisors

Glen Hare is a financial advisor and co-founder of Fox & Hare Financial Advice. He has advised hundreds of young Australians over his career, and we asked him what were some of the most common questions he hears. 26 March

26 March -

General

GeneralInterest rate expectations, supermarket enquiries & ASX 200 rebalance - who's in, who's out?

Every quarter all major market indexes get rebalanced. In this episode we ask - what companies made it in to the ASX200? And which ones fell out? 25 March

25 March -

General

GeneralExpert: Kerry Craig - Portfolio construction and beating home country bias | JP Morgan Asset Management

Today we’re joined by Kerry Craig from JP Morgan Asset Management who is busting us out of our home country bias and helping us right our portfolio construction. 22 March

22 March -

The magic of compounding, Speccy Magee returns & when does Boeing become a good investment?

Just how powerful is compounding? We unpack some of the mind blowing numbers in this episode. 21 March

21 March -

General

GeneralBuy or Sell: Adam Keily with Andrew Page

In today's episode, Adam Keily is joined by Andrew Page of Strawman.com. Do you have a stock you want to ask about? 19 March

19 March -

Top 5 ASX stocks of the past 10 years, TikTok, Temu & Shein make news & a crypto market update

The past 10 years has seen some incredible Australian companies emerge and make their mark here in Australia and around the world. On today’s episode we take a look at the top 5 ASX-listed companies of the past 10 years. 18 March

18 March -

General

GeneralSwitching brokers, terrible financial advice & has Bryce beaten the market?

Bryce has been investing since 2003. In this episode we find out if he has beaten the overall stock market index in that time. 14 March

14 March -

General

GeneralExpert: Aswath Damodaran - Valuation 101: Every number tells a story

For investors of any level, getting your head around valuation is one of the most challenging aspects of investing. So to help us build our skills, we’ve turned to one of the world’s best-known experts on valuation, Aswath Damodaran. 12 March

12 March

- All Series

- Ask An Adviser

- Ask Us Anything

- ASX CEO Connect

- ASX Week

- Broker Basics

- Buy or Sell

- CEO Series

- Country Deep Dive

- Crypto Week

- Expert Investors

- FinFest

- Industry Deep Dive

- Mentored

- Money Management

- Stock Analysis

- Summer Series - Company Deep Dives

- Summer Series 2023

- Summer Series 2024

- Super Saturdays

- Uncovered

- Watchlist Wednesday

Meet your hosts

-

![Alec Renehan]()

Alec Renehan

Alec developed an interest in investing after realising he was spending all that he was earning. Investing became his form of 'forced saving'. While his first investment, Slater and Gordon (SGH), was a resounding failure, he learnt a lot from that experience. He hopes to share those lessons amongst others through the podcast and help people realise that if he can make money investing, anyone can. -

![Bryce Leske]()

Bryce Leske

Bryce has had an interest in the stock market since his parents encouraged him to save 50c a fortnight from the age of 5. Once he had saved $500 he bought his first stock - BKI - a Listed Investment Company (LIC), and since then hasn't stopped. He hopes that Equity Mates can help make investing understandable and accessible. He loves the Essendon Football Club, and lives in Sydney.

Spotify

Spotify Apple Podcasts

Apple Podcasts YouTube Music

YouTube Music