Explore the Equity Mates Media pods

Uncovered

Here at Equity Mates we believe that every company has a story worth telling.

18th Apr, 2024

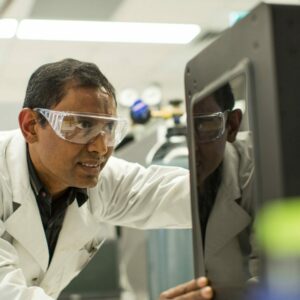

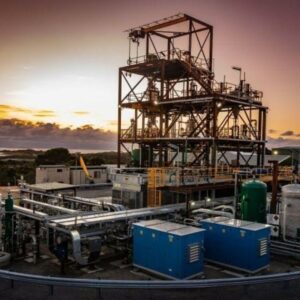

Uncovered: Hazer Group - A new way to make clean hydrogen

Today, the global market for hydrogen is valued at over $150 billion and it is only expected to grow as an important fuel in the world's energy transition.

Sponsored by Hazer Group

12 Steps to Get Started Investing

There is no better place to start than with these 12 hand-picked episodes from our investor primer series, Get Started Investing

14th Jan, 2020

Be Global, Be Different, Get Out of Your Own Way

In this episode, you'll learn:

Three key messages we learnt from Patrick O'Shaughnessy:

1. Go Global - make sure you look outside Australia. The biggest share market in the world is the US; get involved

2. Be Different - don't always follow the crowd. For good returns, consider trying to be a bit different; rather than just ASX200 index, consider one that is for growth, or momentum, or emerging markets; having a mix is important

3. Get Out Of Your Own Way - automate what you can, be consistent; take the emotion out of buying and selling

12th Jan, 2020

Building an investment portfolio

In this episode we debunk the myth that you need to be an expert to build a great portfolio. The truth is, it's simple, as long as you're dedicated, do your own research and are prepared to have some fun. We discuss the simple building blocks that we think are fundamental to building a balanced portfolio. This is achievable for all of us!

7th Jan, 2020

Tips when buying and selling

In this episode you'll learn how to go ahead and buy the shares, how to sell, which types of orders you can use and how to know when to sell.

5th Jan, 2020

How to Find a Good Company

In this episode, we help arm you with the knowledge to sift through all the companies that are out there are narrow down your choices. We provide some specific ways to help you find an investment, and remind you that you don't need to get it right every time!

29th Dec, 2019

Pardon the Jargon: Terms you need to know

At Equity Mates we are the only media company with an official policy on jargon. We hate it and officially are against it. A lot of people in the finance thrive when their clients don't understand what is being discussed and don't know what questions to ask. So, pardon the jargon, but here is some you need to know.

24th Dec, 2019

Just get started: Buying an index

The theme of this episode is all about 'just getting started'. In the spirit of this we are introducing the concept of an index. An index is the perfect opportunity to take the indecision out of getting into the market and giving you access to hundreds of great companies all in one easy trade. It is the perfect way to just get started!

22nd Dec, 2019

First decision every investor makes: Finding a broker

In this episode we answer the big question, "how do I actually buy shares?". We then break down all the factors you should consider so you can be confident in making the first choice in your investing journey.

15th Dec, 2019

Who We Are & Why We Invest

When Equity Mates started we were just like you - unsure of where to start and overwhelmed by the jargon. We used Equity Mates to better understand the market and now we're here to break down the barriers to investing, to make it easier for you. In this series of podcasts we're going to equip you with the knowledge and skills to go from beginning to dividend - in other words, everything from setting up an account, choosing what to invest in, and making your first trade.

15th Dec, 2019

Saving to Invest

One of the most common reasons we hear from people not investing is that they don't have enough money. In this episode we will prove to you why this is certainly not the case, and why learning to save is critical to getting started investing. We'll also share some of our money saving tips that help us keep on top of our savings.

15th Dec, 2019

Basics of Investing

At this point you know why we're investing and hopefully have picked up some good savings habits. So, in this episode we get into the heart of investing and start unpacking all the basics

14th Dec, 2019

What can we invest in?

The beauty of investing is the world of choice that is available to you. Technology has broken down barriers and it has never been easier to access all of the opportunity that is out there. From Australian property to Asian stocks, European bonds to American currency, we can now buy all of these online. With so much opportunity at our fingertips the hardest part is knowing where to start.

31st Dec, 2018

Knowledge is Power: Finding the right information

In this episode we break down how we manage and sift through information and list some of our go-to sources. One of the best and worst things about investing in the 21st century: there is never a shortage of information. You can find more facts and opinions on a company than you'll never need, but it also means you can get lost in this sea of conflicting opinions.