Uncovered is our exploration of the companies that don’t receive as much media attention or analyst coverage. We believe every company has an interesting story and we want to hear them.

Come join us and expand your view of what is possible as we uncover the uncovered.

This page contains sponsored content.

Sparc Technologies emerged out of IP from the University of Adelaide which, as we found out while researching this company, is a world leader in both graphene and renewable energy research.

Researchers at the University of Adelaide had developed technologies to apply graphene in a number of applications including improved coatings for steel. Sparc Technologies was created in 2019 to commercialise this IP.

The problem of steel corrosion

Over time, steel structures corrode and degrade. There is a massive industry in maintaining steel structures including through re-coating with protective paints. In fact, in Australia alone, $78 billion is spent every year remediating assets affected by corrosion. The construction industry is also a major contributor to the world’s greenhouse gas emissions with estimates that corroded steel replacement accounts for 3.4% of global emissions.

This is a problem that the University of Adelaide researchers wanted to help alleviate.

The concept was a graphene-based additive that could instill graphene’s unique properties into paint in order to protect the underlying steel and reduce corrosion. The elegance of this product, named ecosparc, which has been developed by Sparc Technologies over the last five years, is that it can be added to existing marine and protective coatings for steel infrastructure. Owners of buildings and infrastructure are already coating their steel to try and reduce corrosion. Sparc Technologies has extensive testing to demonstrate that adding ecosparc to these existing coatings will improve this protection.

About ecosparc

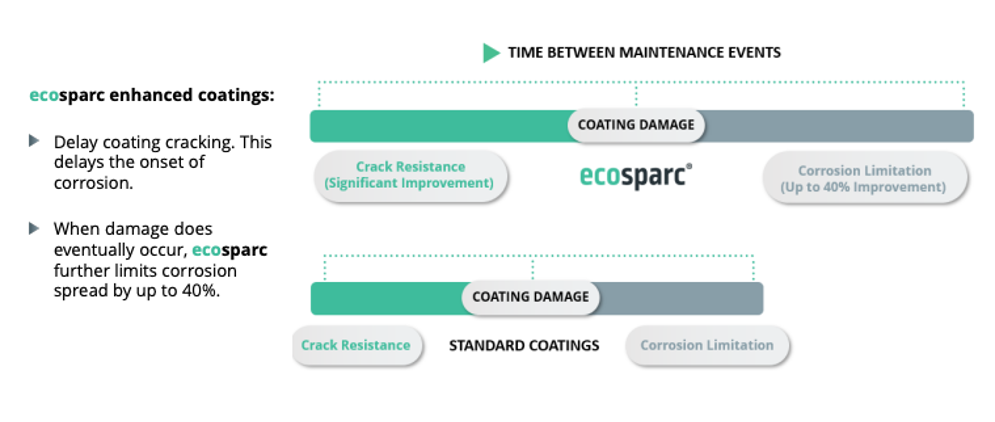

Ecosparc is designed to supercharge existing coatings used to protect steel assets from corrosion through delaying cracking and then limiting the spread of corrosion once cracking occurs. This should allow asset owners (think ports, bridges and heavy industry) to extend the time between maintenance events and ultimately, extend the life of steel assets. All of which translate to big cost and emissions savings.

According to an independent life cycle analysis commissioned by the company in 2023, adding ecosparc leads to a:

- 19-23% savings in maintenance costs; and

- 18-21% reduction in carbon emissions;

relating to re-coating over an asset’s lifetime. Armed with their product and this study, the management of Sparc Technologies are now working to take their coating-additive to the world.

Taking ecosparc to market

The world of paint and coatings is big business, with some deep-pocketed players dominating the market.

Sparc is working to commercialise their technology by collaborating with some of these big players and folding into their existing manufacturing processes and sales pipelines. The company has suggested that they will have results to share with the market on the results of some of these programs in 2024.

At the same time, Sparc is also talking to asset owners directly and educating them on ecosparc and the potential maintenance cost and emissions savings they could enjoy.

This work hasn’t translated to sales yet, but the company has recently announced trials with the South Australian Government to put ecosparc-enhanced paint on two large pieces of infrastructure. Sparc has suggested that they’ll be able to share news of more asset owner trials with the market later in 2024. So watch this space.

Sparc Renewable Energy

While ecosparc is Sparc’s first and most mature technology, the company has used its capabilities and strong relationship with the Australian university sector to extend into other business areas, namely: green hydrogen and sodium ion batteries.

Sparc Hydrogen

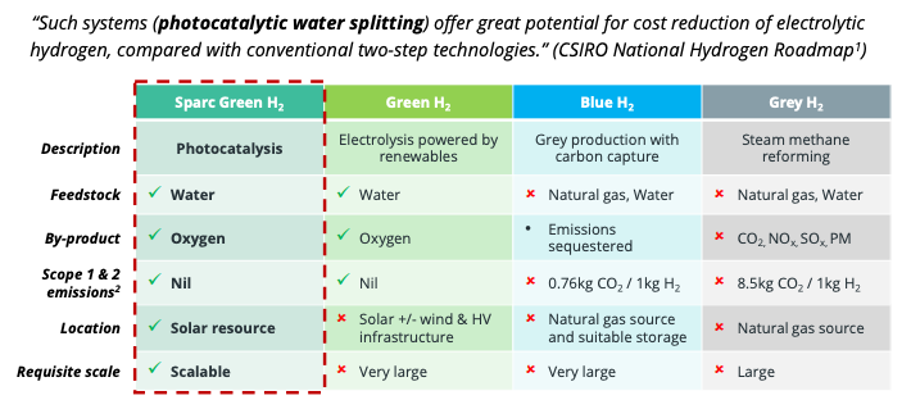

Traditionally, green hydrogen is produced using energy generated from renewable sources to split a water molecule in a process known as electrolysis. This requires vast amounts of electricity along with expensive electrolysers and supporting infrastructure like high voltage transmission lines.

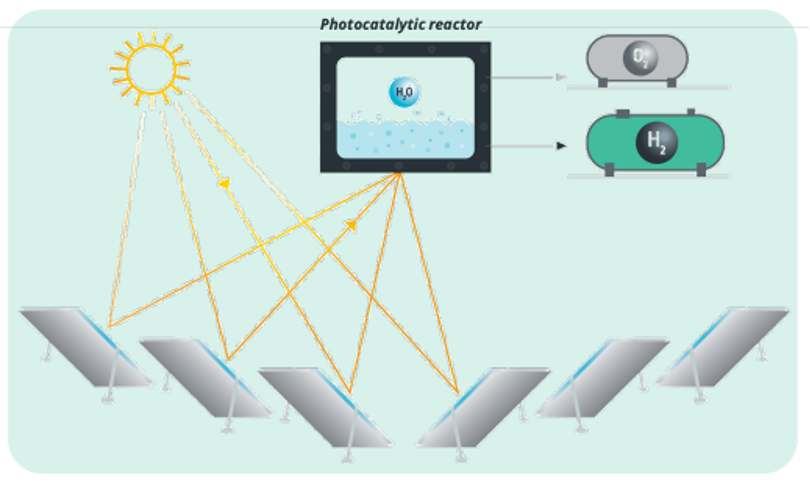

Sparc Technologies via its subsidiary Sparc Hydrogen has been working on a different process – photocatalysis as opposed to electrolysis. This still uses energy from the sun, but it does not require conversion of solar energy into electricity in order to split water using an electrolyser. Instead, the water automatically splits on the surface of a highly engineered photocatalyst material when it is exposed to sunlight.

Sparc Hydrogen is building on this concept through developing a reactor which concentrates sunlight onto a photocatalyst in order to speed up the water splitting reaction and allow it to be incorporated into a modular, scalable mirror field for commercial production.[NO1] [AR2]

The company believes that developing a commercial photocatalytic water splitting reactor would yield significant advantages over other forms of hydrogen production including electrolysis.

The company has partnered with some heavy hitters to develop this technology. Sparc Hydrogen is a joint venture between Sparc Technologies (52% ownership), the University of Adelaide (28%) and Fortescue (20%). The project has attracted grant funding from the Federal Government along with CSIRO’s Kick-Start Program which is supporting recently completed prototyping testwork at the CSIRO Energy Centre in Newcastle.

Together, these partners hope their novel reactor technology can achieve industry leading low cost green hydrogen production through photocatalysis rather than electrolysis.

Sodium Ion Batteries

The third leg of Sparc Technologies’ portfolio is targeting sodium-ion batteries. Once again, the company is developing the technology alongside an Australian university.

Sparc has been working on turning bio-waste into a hard carbon product that could be used as the anode material in sodium-ion batteries. This process represents a sustainable, carbon negative process, transforming waste into high value added products.

Sparc Technologies believe that sodium-ion batteries are “an attractive future battery technology with advantages in grid and industrial scale applications” (FY23 Results Presentation, slide 19) and, to our knowledge, are the only ASX listed company working in this space.

However, globally the interest in sodium-ion batteries is rising amongst some significant players.

All of these companies, including the two largest battery manufacturers in the world (CATL and BYD), are looking to sodium-ion to overcome some of the inherent challenges of lithium-ion batteries. Despite all of the steps forward lithium-ion batteries have enabled (namely, electric vehicles and storage of grid-scale renewable energy), there are serious drawbacks. Material costs are quite high, safety is a concern as lithium-ion batteries have been known to overheat and catch fire and end of life options are limited.

Sodium-ion batteries are seen as an alternative to lithium-ion batteries. They address the major concerns of lithium-ion batteries – namely, they use much lower cost, more abundant materials and are far safer – while still sharing similar energy storage capability and manufacturing techniques.

Financials

All of these technologies sound exciting with use cases across infrastructure, renewable energy and electric vehicles. But at this stage they are all at various stages of research and development. The management of Sparc Technologies has the challenge of turning these technologies into problem-solving, customer-satisfying, revenue-generating products and businesses.

In the first half of FY24, Sparc Technologies did not generate any revenue. In that period it made a loss of $2 million. Similarly in the full year of FY23, the company didn’t generate any meaningful revenue and made a loss of $4.4 million.

Including a recently announced R&D rebate in January 2024, Sparc Technologies has around $2.3 million in cash to fund its operations. This makes it likely that it will need to raise money from shareholders sometime in 2024.

Bringing it all together

Sparc Technologies has diversified its core expertise – graphene and coatings – into a number of new and emerging renewable and sustainability linked technologies. It is partnering with some major institutions – the University of Adelaide, the CSIRO and Fortescue – to develop and commercialise these technologies. All very exciting stuff.

However, it remains early in the journey for Sparc Technologies. As investors, we are watching to see if it is able to successfully commercialise one of its technologies in order to build a track record and deliver revenue to fund these different business lines. Right now, it seems the market is willing to believe in the company with the share price up 31% in the past 6 months. This is important because Sparc Technologies will need to ask investors for more money at some point. Hopefully they can hit some major milestones and keep seeing the share price tick higher before they do. We will be interested to see how Sparc’s management team manage their portfolio of IP, with the potential to spin different business units off to double-down on those they see with the most potential.