Thematic: Renewable Energy

-

-

-

General

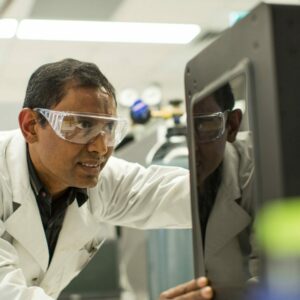

GeneralFrom oil refining to servos - Viva Energy | Summer Series

This episode is focussed on Viva Energy, an Australian company, which holds ownership of the Geelong Oil Refinery and distributes Shell-branded fuels throughout Australia through a license agreement. 1 February

1 FebruarySponsored by CommSec

-

General

GeneralNorway is building the world’s largest wind farm – to power oil and gas fields

The world’s largest floating offshore wind farm seems like a great step forward in the world’s effort to ween itself off fossil fuels. Using that wind farm to extract more oil and gas seems counterintuitive.28th Nov, 2023

-

![Uncovered: Altech Batteries (ASX: ATC)]() General

GeneralUncovered: Altech Batteries (ASX: ATC)

Energy storage is one of the biggest challenges of our transition to a net zero electricity grid. These days, there are plenty of options to generate electricity - solar, wind, hydro - but far fewer options to store electricity.

Storage is important because it can change renewable energy from volatile (generate a lot of electricity, cheaply when the sun is shining and the wind is blowing and then nothing at other times) to reliable. Right now, the world can’t move away from coal or gas as providers of baseload power - the always on, always reliable power source - because of the volatility of renewables.

23rd Oct, 2023

-

![Are carbon offsets all they’re cracked up to be? We tracked one from Kenya to England to find out.]() General

GeneralAre carbon offsets all they’re cracked up to be? We tracked one from Kenya to England to find out.

This article from Vox has tracked a carbon credit as it moves around the world as a way to explain many of the pitfalls in today’s carbon market.23rd Aug, 2023

-

The Power of Uranium: Stock ideas & chats with Peninsula Energy's CEO

In today's podcast, we're thrilled to introduce Wayne Heili, who serves as the Managing Director and CEO of Peninsula Energy 7 July

7 July -

General

GeneralDigging into the Global Natural Resources Sector with Terra Capital

Terra Capital is a leading investment manager specialising in natural resources, achieving impressive returns on their diverse portfolio with a disciplined approach, industry expertise, and a focus on renewable energy and sustainable investments. Candice and Felicity are joined by Jeremy Bond and Matthew Langsford in today’s episode. 24 February

24 February -

![How Australia became the world's great lithium supplier]() General

GeneralHow Australia became the world's great lithium supplier

The article also explores a key question at the heart of our renewable energy transition - how can we mine lithium sustainably?24th Nov, 2022

-

3 takeaways from Finfest & some investible ideas for the current market

Candice and Felicity swap notes on their takeaways from Equity Mates' Finfest last weekend, and then dive into the latest Shaw and Partners macroeconomic data. They talk portfolio themes and investible ideas to compare to what was pitched by other Fundies at FinFest. Because a bit of healthy competition never hurt anyone! 21 October

21 October -

Mike Cannon-Brookes, AGL, and the future of coal

AGL is Australia’s oldest and largest electricity generator. It is also Australia’s largest emitter of carbon dioxide. The company plans to shut its last coal fired generator in 2045. And has been resisting calls for it to accelerate plans to shut down its coal fired power plants. Which has put it in conflict with Mike Cannon-Brookes, who has been using his considerable wealth to try and accelerate Australia’s transition to a zero emission energy grid. This week this conflict came to a head and ended with AGL’s CEO and Chair of the Board resigning. In today's episode of The Dive, Alec and Darcy discuss what happened with Mike Cannon-Brookes and AGL . And explain what this story means for the future of Australia’s electricity grid? 4 June

4 June -

![Wind power's 'colossal market failure' threatens climate fight]() General

GeneralWind power's 'colossal market failure' threatens climate fight

Many of the expert investors we have spoken to have discussed the opportunities in the wind power supply chain. Unlike the solar panel industry, which is fragmented across many players, wind power turbines are only built by a few big players - Vestas being the market leader and one we often hear discussed. This article outlines some of the problems being faced by Vestas and their big competitors. Higher input costs, supply chain bottlenecks, changes in key clean-power subsidies and pressure on turbine prices is challenging profitability across the whole industry. This is slowing down the rate of production, just as the world needs it to ramp up.17th May, 2022

-

Investing in renewable energy | ASX Game

We're excited because we're checking back in on the ASX Sharemarket game this week! A reminder, participants in the game get to invest $50,000 in virtual cash in the S&P/ASX200, a range of ETFs and a selection of small and mid-cap companies... we first invested on 3 March and we love how the game lets us get a good taste for how the market moves, how your investments are tracking, without having to invest any of your own money. This week we take a little review of how we're going (spoiler - not great) and then throw around some ideas of some themes we're interested in adding to the portfolio - Hydrogen and Lithium. 10 May

10 May -

![The biggest opportunity since the internet]() General

GeneralThe biggest opportunity since the internet

You could be forgiven for believing that your outrage has fallen on deaf ears, especially in Australia. However, the overwhelming worldwide demand for ESG and socially responsible initiatives from customers, employees and shareholders has influenced most corporations in changing their behaviour - virtually every company we meet is talking about their sustainability goals.10th Mar, 2022

Source: Munro Partners

-

Can markets front-run the govt on climate? Special EP.

Adam is bludging this week, so Thomas has his mate Tim on, who's an expert in energy economics. They take stock of COP26 and see where markets are front-running the governments (lack of) action. And what does Australia as a Clean Energy SuperPower look like? 24 November

24 November -

![A Look at Sun Cable, One of Australia's Most Ambitious Renewable Projects]() General

GeneralA Look at Sun Cable, One of Australia's Most Ambitious Renewable Projects

While our federal government drags their feet on climate policy and the state governments and the business community are forced to take the lead, we're seeing some exciting projects progress. The opportunity for Australia to be a net exporter of green, renewable energy is within reach if some of these projects can be realised.20th Nov, 2021

-

ASX week: Alison Savas - Two winners from decarbonisation

In this episode, Bryce and Alec chat to Alison Savas - Antipodes’ Client Portfolio Manager. Alison has almost two decades of experience in the investment management industry, working for leading managers in Australia and Singapore. Antipodes have an active-ETF listed on the ASX, ticker code AGX1. In this conversation they talk about decarbonisation, get Alison's thoughts on what is happening internationally in this thematic, and then Alison talks about two specific stocks in greater detail. 12 November

12 NovemberSponsored by Australian Securities Exchange (ASX)

-

Industry Deep Dive: Solar - The world's cheapest renewable energy

Today, we’re going to discuss the energy transition, and the investment opportunity of decarbonisation. This episode is proudly sponsored by InStyle Solar, one of the largest solar companies in Australia, and a Clean Energy Council approved retailer. Not only is solar a clean energy solution, but there are plenty of financial benefits as well, some of which we’ll touch on later in this episode. 25 October

25 OctoberSponsored by InStyle Solar

-

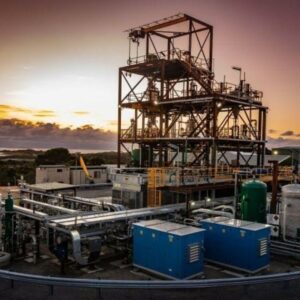

Industry Deep Dive: Investing In Renewable Energy

In this episode, we deep dive into the renewable energy industry. Ørsted A/S, a Danish power company, was recently named the most sustainable company in the world. 11 May

11 May