![]() Podcast 736 episodes

Podcast 736 episodes

Equity Mates Investing Podcast

Back in 2017, Bryce and Ren (otherwise known as Alec), found themselves at the beginning of their investing journey. They wanted to learn more, and educate themselves about stocks, the market, and understand what all those jargon words mean. They were daunted about starting, but thought why not document the journey the whole way on a podcast.

Today, Equity Mates is Australia’s best investing podcast for millennials. Twice a week, Bryce and Alec will take you from beginning to dividend, chat to leading experts, and CEOs of companies they respect and admire.

Join our community of Equity Mates, and start your journey now!

Listen On

Experts Interviews

Hear from the best investing experts from around the world

22 hours ago

Expert: Roger Montgomery - 5 stocks he's buying today

11th Apr, 2024

Expert: Joe Wright - Three ways to invest in resources | Airlie Funds Management

Sponsored by Airlie Funds Management

1st Apr, 2024

Expert: Sam Gordon - Rentvesting, Equity Recycling & what is going on with Aussie property?

28th Mar, 2024

Expert: Ben McVicar & Jowell Amores - Infrastructure: Invest in where the world is going

Sponsored by Magellan Asset Management

21st Mar, 2024

Expert: Kerry Craig - Portfolio construction and beating home country bias | JP Morgan Asset Management

11th Mar, 2024

Expert: Aswath Damodaran - Valuation 101: Every number tells a story

Uncovered

Every company has a story worth telling

5 days ago

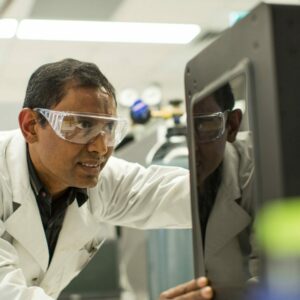

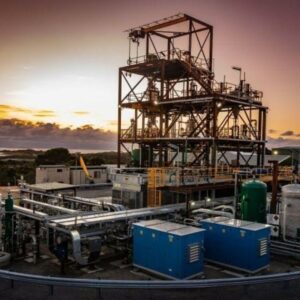

Uncovered: Hazer Group - A new way to make clean hydrogen

Sponsored by Hazer Group

Episodes

-

General

GeneralAsk An Advisor: Phil Thompson - You'll never think about insurance the same

We all know it’s important, but in this episode Phil Thompson from Skye Wealth takes us through how we can approach it. 5 March

5 March -

General

GeneralPimp my Portfolio, two investor letters & what do UGG and Hoka have in common?

A big episode to start the week here at Equity Mates. We: Hear Bryce pitch a stock, Are joined by Maddy for Pimp my Portfolio, Unpack the lessons from 2 investor letters 4 March

4 March -

General

GeneralUncovered: Emyria - Bringing psychedelic-assisted therapies to Australia

We speak to Dr Michael Winlo, CEO and Managing Director of Emyria (ASX: EMD) about the recent rescheduling of MDMA and psilocybin and his company’s efforts to introduce psychedelic-assisted therapy into Australia. 1 March

1 March -

General

GeneralRen's 2024 portfolio, ETF question & expert stock pitch: Australian Financial Group

Wondering how we set up our portfolios here at Equity Mates? In this episode we cover how we’re investing for 2024, across both our core and satellite portfolios. 29 February

29 February -

General

GeneralBuy or Sell: Adam Keily with Julian McCormack

For the first time in 2024, Adam Keily is back on the podcast with his latest Buy or Sell episode. He is joined by Julian McCormack of Platinum Asset Management to go through some of the companies he’s buying and selling. 27 February

27 February -

General

GeneralSemiconductors beyond Nvidia, Book club is back & introducing: Pimp my Portfolio

Nvidia, Nvidia, Nvidia, Nvidia. It seems like every financial media company has to hit a quota of mentions about the technology giant. That hopefully fills ours. 26 February

26 February -

Earnings season takeaways, an ASX 10-bagger & community stock idea

Earnings season is in full swing and we cover a number of companies that have caught our eye: Commonwealth Bank, A2 Milk, Cochlear, Lionstown, Domino's Pizza, Cettire & more. 22 February

22 February -

General

GeneralBold predictions - Andrew Brown

Every year Andrew Brown, Executive Director of East 72 Dynasty Trust, joins us to make some bold predictions for the year ahead. 20 February

20 February -

General

GeneralWe're back with our Stock of the Year & Bold Predictions

We’re back for 2024! And we’ve got a lot to catch up on. In this episode we: Cover what happened over the break (both in our lives and in markets) Share our bold predictions for the year ahead Each pick our stock of the year 19 February

19 February -

General

GeneralSelling car parts, buying back stock - Autozone | Summer Series

AutoZone, Inc., the leading American retailer in aftermarket automotive parts and accessories, stands as the largest of its kind in the United States. 15 February

15 FebruarySponsored by CommSec

-

General

GeneralWill US fixed mortgage rates lead to a renovation boom? - Lowes | Summer Series

Today we're talking about Lowes - not to be confused with Australia's Lowes - this is a hardware giant listed over in the US. Headquartered in Mooresville, North Carolina, the company operates a chain of retail stores in the United States. 12 February

12 FebruarySponsored by CommSec

-

Averaging 26% a year for 17 years, what next? - Mineral Resources | Summer Series

Mineral Resources Limited (MRL), an Australian company, specialises in diversified mining services and resources, focusing on iron ore, lithium, and energy. As one of Australia's leading iron ore producers and a significant producer of lithium spodumene concentrate, MRL is committed to being a world-class entity in its field. 8 February

8 FebruarySponsored by CommSec

-

General

GeneralIt's all in the name - Corporate Travel Management | Summer Series

This episode it's Corporate Travel Management Ltd, a travel management company, originated in Australia and has since expanded its operations to include the United States and the United Kingdom 5 February

5 FebruarySponsored by CommSec

-

General

GeneralFrom oil refining to servos - Viva Energy | Summer Series

This episode is focussed on Viva Energy, an Australian company, which holds ownership of the Geelong Oil Refinery and distributes Shell-branded fuels throughout Australia through a license agreement. 1 February

1 FebruarySponsored by CommSec

-

Designing the AI revolution - Altium | Summer Series

Altium Limited is an American - Australian multinational software company that provides electronic design automation software to engineers who design printed circuit boards. 29 January

29 JanuarySponsored by CommSec

-

General

GeneralRiding the boom in aesthetic medicine - InMode | Summer Series

We're joined by Tobias Carlisle, Principal at Acquirers Funds, who helps us explain what InMode does, tells us which metrics matter and which ones don’t, and where the company is trying to build a sustainable competitive advantage. 25 January

25 JanuarySponsored by CommSec

-

The Aussie small cap taking on the tech giants - Dropsuite | Summer Series

Dropsuite Limited, founded in 2011 as Dropmysite, is a Singapore-based software platform specialising in cloud backup, archiving, and recovery services, catering primarily to business continuity and compliance needs of large companies, not personal devices. 22 January

22 JanuarySponsored by CommSec

-

General

GeneralAustralia: the land of the packaging giant - Orora | Summer Series

Orora Group, established as Australian Glass Manufacturers in 1949, has evolved into a global leader in packaging manufacturing, distribution, and visual communication solutions. 18 January

18 JanuarySponsored by CommSec

-

General

GeneralDoes Google have any growth left? - Alphabet | Summer Series

Alphabet, the parent company of Google, operates through three primary segments: Google Services, Google Cloud, and Other Bets, with Google Services being its largest, generating $283.53 billion in revenue, largely driven by Google Ads and YouTube, which accounts for approximately 11% of Google's revenue 15 January

15 JanuarySponsored by CommSec

-

General

GeneralCreating a three-sided trucking marketplace - Landstar System | Summer Series

Landstar System, Inc. is revolutionising the American trucking industry by operating as a unique marketplace, connecting a fragmented network of over 50,000 independent truckers with hundreds of thousands of businesses needing freight services. 11 January

11 JanuarySponsored by CommSec

-

General

GeneralUp more than 200% in 2023, what does 2024 hold? - Nvidia | Summer Series

This year we're kicking off with NVIDIA, renowned for its innovation in graphics processing units (GPUs) and system on a chip units (SoCs). 8 January

8 JanuarySponsored by CommSec

-

We look back at 2023 and reveal the winners of the Equity Mates Awards

We reveal your Expert of the Year, as well as the themes, stocks, and platforms you're talking about! 18 December

18 December -

General

GeneralExpert: Andrew Brown - Bold predictions wrap 2023

Welcome back Andrew! Since Equity Mates began, we've been welcoming Andrew to come and make some bold calls to bookend our year. 14 December

14 December -

We wrap our bold predictions + Who won stock of the year?

Find out which companies we thought would outperform in the market and who might win Time’s Person of the Year. What did we end up scoring? 11 December

11 December -

General

GeneralExpert: Kerry Craig - Interest rates, China, Climate & AI | J.P. Morgan Asset Management

Kerry Craig is a Global Market Strategist at J.P. Morgan Asset Management, and joins us today to talk about the Long-Term Capital Market Assumptions series. 8 December

8 December

- All Series

- Ask An Adviser

- Ask Us Anything

- ASX CEO Connect

- ASX Week

- Broker Basics

- Buy or Sell

- CEO Series

- Country Deep Dive

- Crypto Week

- Expert Investors

- FinFest

- Industry Deep Dive

- Mentored

- Money Management

- Stock Analysis

- Summer Series - Company Deep Dives

- Summer Series 2023

- Summer Series 2024

- Super Saturdays

- Uncovered

- Watchlist Wednesday

Meet your hosts

-

![Alec Renehan]()

Alec Renehan

Alec developed an interest in investing after realising he was spending all that he was earning. Investing became his form of 'forced saving'. While his first investment, Slater and Gordon (SGH), was a resounding failure, he learnt a lot from that experience. He hopes to share those lessons amongst others through the podcast and help people realise that if he can make money investing, anyone can. -

![Bryce Leske]()

Bryce Leske

Bryce has had an interest in the stock market since his parents encouraged him to save 50c a fortnight from the age of 5. Once he had saved $500 he bought his first stock - BKI - a Listed Investment Company (LIC), and since then hasn't stopped. He hopes that Equity Mates can help make investing understandable and accessible. He loves the Essendon Football Club, and lives in Sydney.

Spotify

Spotify Apple Podcasts

Apple Podcasts YouTube Music

YouTube Music