This article has been written by expert contributor Duncan Burns, Head of Investments, Asia-Pacific and Head of Equity Index Group, Asia Pacific, Vanguard Australia

It’s easy to forget about the long-term

It’s easy to forget about the long-term trajectory of share markets in a period of downturn. But if you’re invested in equities for the long-term, know that markets will consistently trend upwards over time.

Watching share market movements has probably felt like a bad rollercoaster ride for many investors recently, given the ASX and many global stock indexes are spending more time in the red than most of us are used to.

And when it’s hard to see anything but trouble ahead for equities, moving into defensive assets such as cash might seem a tempting way to protect your nest-egg. While a partial de-risking of your portfolio probably makes sense if you are nearing or already in retirement, what about if you’re at the peak of your earning years, with retirement at least a few decades away? It would be an entirely different story and what your emotions are imploring you to do are almost certainly at odds with what’s right for your long-term investment success.

For one, exiting the share market now will lock in losses permanently. Grappling with figuring out when to return is another dilemma. Oftentimes, the flight to “safety” money is not reinvested until confidence returns and the market has already recovered, at which time you’re firmly ensconced in the dreaded sell low/buy high trap.

Looking at hard data can help in times like these

However, looking more closely at hard data can help in times like these and thinking logically about why the stock market goes up can support better trading and portfolio decisions.

The ASX share market goes up on average 10% a year and should continue to increase over the next few decades, because businesses generally get bigger and more profitable over time. And because a single share represents fractional ownership of a business or corporation, investors benefit from innovation and investment, and partake in the growth of profits, cash flows and business results. This drives the long-term uptrend in the share market, making it one of the greatest wealth creation machines of all time, and that’s why it’s usually the core of your super and other long-term portfolios.

It is easy to forget about this long-term trajectory of the share market when it has one of its periodic downturns. But if you’re invested in equities for the long-term and have time on your side, know that the long-term uptrend is there for support.

For example, if you held an all-equity portfolio in the ASX from 1970 to 2020, your average yearly return over the half century would be about 10%. But your yearly returns would have ranged anywhere from a gain of +41% in 1993 to a loss of -39% in 2008. That’s a lot of volatility and possibly too much risk to stomach if the need for capital was right around the corner.

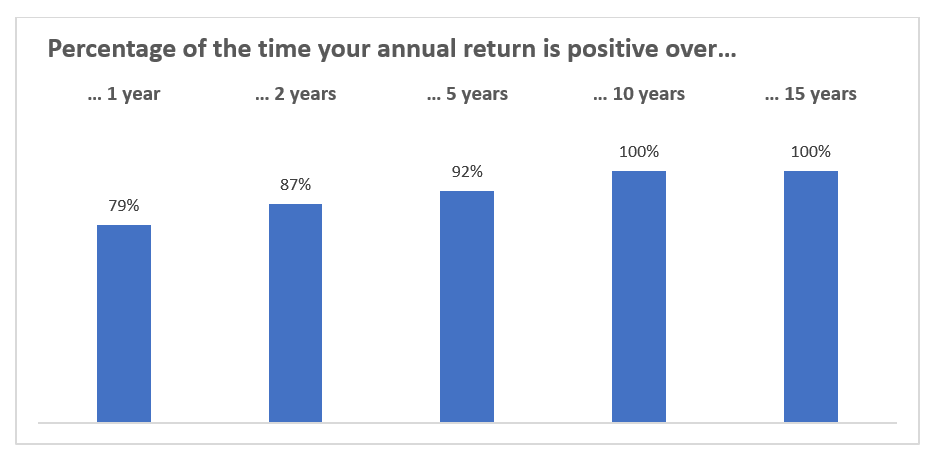

But if your investment horizon is more than 5, 10 or 20 years, the rolling average returns in the equity market over these longer periods paints a different, more compelling picture. As you’d expect, the return gaps between the highs and lows over rolling average 5, 10 or 20-year periods get much narrower and in fact, the historical data shows that after the first decade, returns go 100% positive. So while past performance is no guarantee of future results, the lesson here is that letting markets and time work for you is a terrific way to tap into the long term growth of the economy with your portfolio.

Source: Vanguard calculations based on Bloomberg data

Notes: Chart uses data from a spliced index comprised of MSCI Australia Total Return Index from 1970 to 1992 and the ASX 300 Total Return index from 1992 through 2021.

If you can, resist the temptation to think you can pick and choose when to sit on the sidelines.

By selecting sound low-cost equity investment vehicles and staying with them for the long haul, you are almost certain to grow your wealth, thanks to the accumulation of reinvested earnings and share price appreciation. If your holding period is sufficient, you can be highly confident that your portfolio will grow with the top 300 listed corporations in Australia. Don’t give up on the greatest wealth creation machine of all time and don’t let market fluctuations change your mind about the important role equities play in your super fund and other long term investment strategies.

Duncan Burns is the Head of Investments and Head of Equity Index Group for Asia-Pacific at Vanguard Australia. He is also a member of the Australian executive team. In these roles, Duncan leads Vanguard’s experienced team of investment management and strategy professionals in Australia and Asia. He also oversees the management of Vanguard’s Australian and global equity index portfolios and the firm’s trading operations in the Asia-Pacific region.

Learn more about Vanguard here.

The above material has been republished with the permission of Vanguard Investments Australia Ltd. Prior to making an investment decision, retail investors should seek advice from their financial adviser. This document is intended as general information only.