This article has been written by expert contributors, Ayesha Khalid and Thushka Maharaj, D.Phil, CFA,Global Strategist Multi-Asset Solutions, J.P. Morgan Asset Management.

In brief

- Recession risks have moderated in the last month as employment and spending data have held up well. At the same time, our disinflation forecast is finally finding vindication in the hard data. Strong conviction in the disinflation theme is a key driver of our asset allocation views.

- We maintain a positive stance on duration, which should benefit as inflation continues to cool and central banks judge rate hikes less urgent. While we see emerging signs that wage pressures have peaked, we are watchful as the issue poses a key risk to our positive view on duration. This concern, together with the high negative costs of carrying duration, moderates conviction in our duration view.

- Equity investors have benefited from the disinflation narrative and taken some comfort from lower recession risks. We expect equity markets to weather the disinflation process well, as it reduces the risks of aggressive monetary policy tightening. While earnings growth looks to be in the process of troughing, forward earnings growth remains constrained by the late cycle environment and high financing costs. This keeps us neutral on risk assets at this juncture.

Economic data over the last month corroborated our base case outlook of gradually slowing growth and decelerating inflation. Simply put, our long-held disinflation forecast is finally finding vindication in the hard data.

The better-than-expected June CPI report, on both headline and core inflation metrics, proved pivotal in shifting the market narrative toward a more sanguine view on inflation. For investors, relief on the growth-inflation tradeoff supported both equities and core government bonds.

In this report we discuss how lower recession odds in conjunction with greater conviction in the disinflation narrative impact our asset allocation views.

Disinflation trend: Sustainable, but choppy

Activity data continues to surprise to the upside. While job growth is slowing gradually, steep job losses have not materialized, as some had feared earlier this year. Better initial jobless claims data, sustained consumer spending and improvements in the housing market all point to an extension of the business cycle. Our base case calls for distinctly sub-trend growth in coming months as the economy adjusts to higher financing costs and consumers run down their excess savings. We lowered the odds of a recession over the next 6-9 months, but still keep an elevated risk longer term.

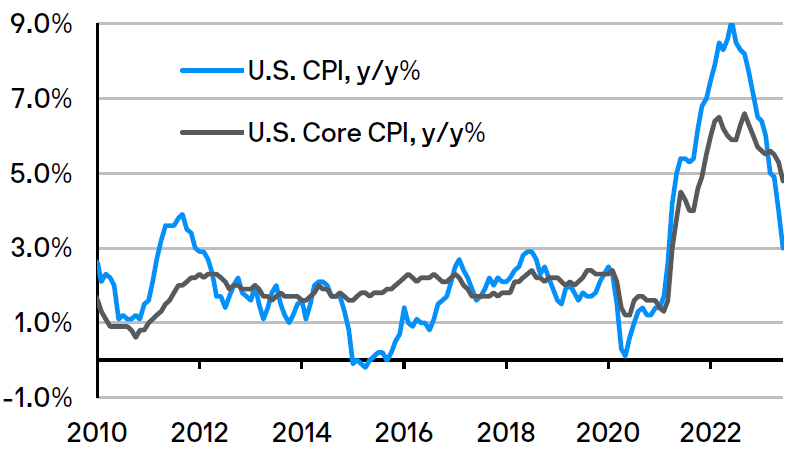

Our long-held forecast for disinflation has finally shown up in the U.S. data and we find encouraging signs that the theme will play out further and broaden across sectors. Headline inflation showed the most encouraging improvement with a 100 basis points (bps) fall to 3%, the lowest level since 1Q 2021 (Exhibit 1). We expect further disinflation to take hold as energy base effects fade and supply chain disruptions ameliorate.

U.S. headline and core CPI are heading lower

Exhibit 1: U.S. headline and core CPI, y/y, %

Source: Bloomberg, BEA; data as of June 30, 2023.

What’s more, we expect diminished growth momentum due to monetary policy tightening to feed through to slowing inflation. Already we see weaker import price indicators, signs of a peak in producer prices and a strong anchoring of long- term inflation expectations – all of which signal ongoing and sustained disinflation.

Core services ex shelter, the Federal Reserve’s measure of supercore inflation and the metric most sensitive to wage growth and labor market conditions, has moderated to a mere 0.1% month-over-month. The risk of an entrenched wage-price spiral seems more remote than it had even six months ago. In addition, the disinflation trend is becoming more global, with the UK and Canada showing more signs of following the U.S. path.

Bond markets: Positive on duration, but a bumpy ride

Bond markets have been caught between countervailing forces – a resilient growth outlook and lower recession odds vs. hard evidence of cooling inflation. U.S. 10-year Treasury yields at the start of the month hit a high of 4.1%, just off the peak reached in Q4 last year. But after the surprisingly good June CPI report, yields fell to 3.8%.

Confirmation of cooling inflation on multiple fronts, along with forward-looking indicators pointing to further disinflation in the pipeline support our positive duration view. We expect the bond market to take its cues from the disinflation trend as inflation data, more than anything, will ultimately guide central bank decision making.

Inflation is not vanquished. It will remain volatile and we can see arguments for why bond market volatility, as measured by the MOVE index, will remain elevated. Strong domestic demand coupled with tight labor markets could lead to sustained wage pressures that ultimately feed through into persistent inflation. Thus, we remain vigilant to developments on labor wage negotiations.

Equity markets: Broadening leadership, margins may hold up

Even as fervor for the artificial intelligence (AI) theme helped drive a rally in the S&P 500 in the first half of the year, stock markets (particularly the tech-heavy NASDAQ), warmly welcomed evidence of cooling inflation and labor market rebalancing.

Over the last month, the S&P 500’s valuation continued to expand, and currently trades at a 12-month forward P/E multiple of 19.5x, which is 18% above its long-term historical average. As it becomes clearer that inflation is gradually moving toward the Fed’s target, and growth and activity data come in better than expected, the stock market has begun to broaden beyond the narrow leadership of the “Magnificent Seven” tech stocks. Over the last two months, cyclical sectors such as Industrials, which had lagged thus far into the year, also began to perform.

From the perspective of an equity investor, the disinflation narrative importantly reduces the risk that the Fed will overtighten and push the economy into a recession. Disinflation can also serve as a tax cut for consumers, who benefit from falling energy and food prices, which in turn supports spending. The trend also allows for interest rates to stabilize, which helps cap corporates’ financing costs. Thus, in a non-recession world, disinflation is generally positive for equities as valuations have room to expand.

However, disinflation can also raise questions about corporates’ ability to maintain top-line growth, which can ultimately cap multiple expansion. Typically, in a more inflationary environment of higher nominal growth, corporates pass on their input cost increases to consumers, which tends to support margins. In a disinflationary environment, falling headline inflation can reduce corporates’ input and financing costs, but the disinflation-induced drag on nominal growth tends to depress corporate revenues. In such a scenario, the fall in input costs may not keep up with the fall in revenues, thus eroding corporate margins.

If one critical input cost for corporates, wage inflation, picks up steam, it would further pressure margins. Trends in unit labor costs suggest this is not a current issue – wage measures show signs of peaking – but it remains a key risk to monitor for firms in many sectors.

In our view, the impact of disinflation on corporate margins will ultimately reflect the broader economic growth backdrop, as well as the strength (or weakness) of consumer demand. Amid sub-trend growth and cooling inflation, our base case over the next 6-12 months, consumer demand could continue to prove resilient, allowing margins to remain stable.

Asset allocation implications

Our multi-asset portfolios remain overweight duration, concentrated in the U.S. Treasury market. We hold this view with high conviction, yet high returns on cash still keep us from taking outsized directional bets. Negative carry costs, together with elevated bond volatility, call for prudent sizing of our duration positions.

In equities (and risk assets generally) we remain broadly neutral. But given momentum and positioning, we see ongoing risk of a summer grind higher in stock markets. In our view, lower inflation mitigates the fear of a Fed-induced recession, and at the margin lower recession odds lend support to equities. At the same time, we find it difficult to envisage an extended or sharp earnings upcycle in what feels like an extended late-cycle environment. While we see scope for an earnings recovery, the trajectory is likely to be pedestrian.

In such an environment we expect to seek alpha opportunities in relative value trades – in regions where we see idiosyncratic growth stories, or in sectors that stand to benefit as concerns about recession abate.

The J.P Morgan Asset Management Market Insights program provides comprehensive data and commentary on global markets without reference to products. Designed as a tool to help clients understand the markets and support investment decision-making, the program explores the implications of current economic data and changing market conditions.

This document is a general communication being provided for informational purposes only. Prior to making an investment decision, retail investors should seek advice from their financial adviser. This document is intended as general information only.