This article has been written by an expert contributor Henry Jennings from Marcus Today

Back in 1976, Sir Laurence Olivier was torturing Dustin Hoffman with some dental work in the film, Marathon Man. ‘Is it safe?’ he asked.

‘Yes, it’s safe, it’s very safe, it’s so safe you wouldn’t believe it’ was Hoffman’s response. Is it safe was the question again? ‘No. It’s not safe, it’s… very dangerous, be careful’. And that is where we find ourselves in now.

The big question, is it safe? The answer is ‘no’. But it is never safe. Not truly. Nothing ever is. Life is not safe. It is a question of risk versus reward. That question, in market terms, also considers timeframe. If you are a long-term investor there could be some extraordinary bargains around. Things to regale your grandchildren with; I bought ZIP at under a dollar. Tell me more grandpa, how did you ever manage that? Or I didn’t buy ZIP, I thought about it but luckily missed it. Oh, you are so clever Grandpa.

It is never safe at all. But if you have a plan and you can execute that plan without the emotional rollercoaster we have now, then you will do better than poor old Dustin Hoffman having his teeth drilled.

It is all about risk versus reward. Finding stocks that have been unfairly treated, with valuations now back to attractive levels and believing in the business. Doing the research and putting in the effort. Taking the risk after evaluating the reward.

Locally, the ASX 200 has ridden the recent nauseating volatility far better than the US so far. Our miners and banks have seen to that, but underneath it all, many stocks have been smashed. Many fallen angels out there. Even solid, established businesses in the tech space; REA, CAR and SEK have been hit hard. It is a 30% off EOFY sale in some stocks. XRO is down 40% from its highs.

When we see the ‘Sale’ sign at David Jones, do we walk off and avoid the mall? No. We take advantage of the sale. Even if it’s a bit out of season. We will need those board shorts come summer. So, what could be a good bargain when it comes to stocks?

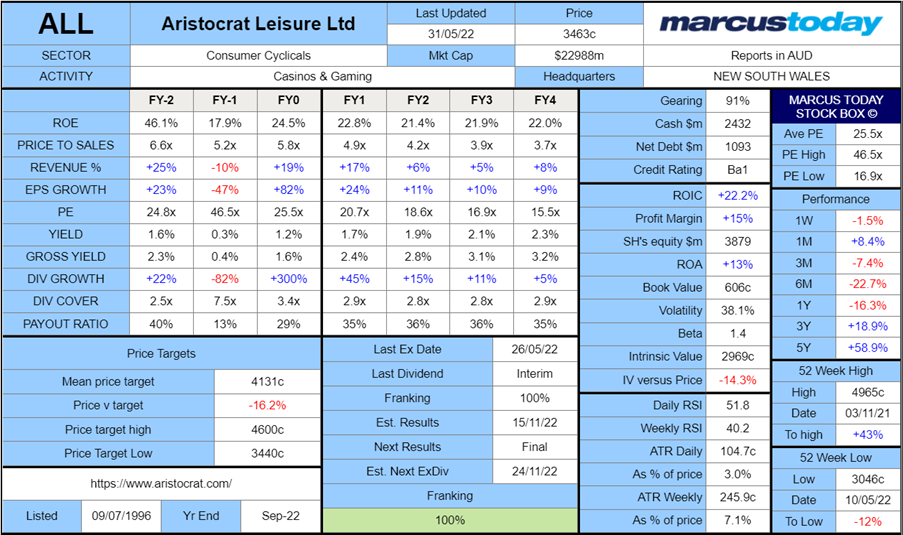

One such stock is Aristocrat (ALL)

A near 30% fall from grace after it raised capital to buy Playtech. It failed and now is returning some of that capital to shareholders through an on market buy back. $500m of buying to support the share price. It has suffered as tech stocks have fallen. It has suffered from missing out on Playtech. It has suffered from costs involved in scaling up its online gaming offerings and supply chain issues. The digital games launch has been delayed with the Ukrainian war probably not the best time to launch “Magic Wars: Army of Chaos”. It’s not easy being a Pixel United (formerly Aristocrat Digital) employee in Ukraine either. Of the 1000 employees, 70% have had to be relocated. But the gaming pipeline now looks strong. The US opportunity is still huge, and the company is at the forefront of gaming technology. The North American total addressable market could reach US$25-30bn by 2030. Trading on a 19x FY23 P/E, with a strong balance sheet and growth runway. Worth pushing the button for a chance at a jackpot.

The data is provided by Refinitiv and is up to date as at close of business on 30th May, 2022.

More about the author – Henry Jennings

Henry Jennings, Senior Market Analyst and Media Commentator at Marcus Today Stock Market Newsletter, has been involved in financial markets since the 80s in London before emigrating to Australia. He first joined Deutsche Bank and then Macquarie Bank as Head of Equity Trading in Sydney. Since leaving Macquarie, Henry has been both an institutional and private client adviser. For the last seven years, Henry has been writing strategy and insights daily and is a frequent media commentator on all things finance on ABC TV and Radio, SBS and Ausbiz. He also hosts a series of podcasts talking to industry experts and the popular live Ask the Analyst session for Marcus Today.

You can sign up for a free trial here.

Prior to making an investment decision, retail investors should seek advice from their financial adviser. This document is intended as general information only.