This article has been written by an expert contributor from Loftus Peak

Strong earnings, weak markets

Inflation is here and so interest and other costs will rise, which means that margins will be squeezed. Less of each dollar of revenue will go to shareholders, making returns harder to get. But that is only part of the story.

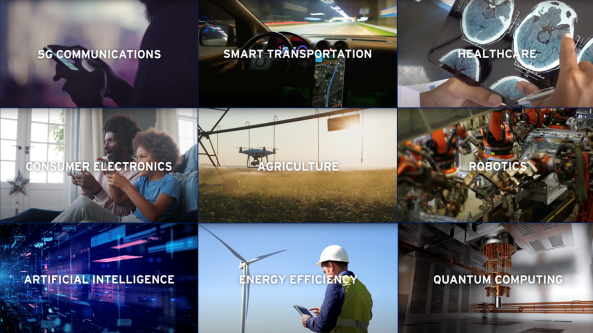

At the heart of disruption are more efficient solutions across all industries – for example sensors which send signals to reduce waste and improve productivity, or supercomputers to design vaccines for COVID.

This has driven a burgeoning need for semiconductors globally in areas not previously as dependent on them – like cars, genetics, agriculture and power grids, resulting in a long-term uplift in demand.

It’s not just the increasing need for ‘smarts’ in anything and everything either. Long-term secular trends such as the shift of traditional TV advertising budgets to better, more effective methods supported by the growth of Connected Television (CTV) are also powering ahead.

These are powerful disruptive forces, continually pushing consumers and businesses towards faster and more efficient, scalable solutions.

Loftus Peak remain cautious about the macroeconomic and geopolitical backdrop, and are stocking their Fund with quality companies that are positioned to grow as a result of these long-term secular trends. Importantly, they remain focused on company fundamentals, reporting of which to date has been solid, as shown below.

Disruptive trends evident in latest earnings releases

Taiwan Semiconductor Manufacturing Company reiterates CAPEX of US$110bn over next three years

The world’s premier maker of top-end microprocessors delivered a quarter which was up 20% in revenue, with margins and earnings per share both up strongly. Revenue for the rest of 2022 is forecast to be over 20% higher. The only negative commentary was weakness in smartphones and laptops.

Share of revenue for TSMC’s Internet of Things (IoT) and Automotive divisions didn’t change much between Q1 2019 and Q1 2022 – but that is in the context of the company’s overall revenue growing 147% over that same period! TSMC’s performance and commentary provides important proof of the secular trends we have pointed to in previous notes, such as the increased semiconductor content of cars (for Automotive) and an increasingly connected world (for IoT).

Meta (Facebook) surprises on ecosystem metrics

The market thought Meta (Facebook) numbers, especially growth of 6% in users, was solid, while giving the company the benefit of the doubt for slowing revenue growth (tough comparables and normalising for a crackdown in advertising tracking). Investors also are ignoring the massive spend it has committed to virtual reality, a spend which is expected to absorb all the earnings growth of the core business for the next five years. This is a huge bet, probably larger than that which the company took migrating the business from desktop to mobile ten years ago, which was risky, but turned out to be a necessary and hugely profitable move. Meta jumped 18% on its earnings news, the only company mentioned above to go up convincingly after results.

Alphabet (Google) – search and cloud resilient, YouTube growth slowing

The bar was higher for another of the Fund’s digital advertising exposures, Alphabet (Google), which delivered roughly in-line results. Search is as important as it’s ever been, with strength in retail and travel powering the 24% year-over-year growth in the segment, perhaps running contrary to how some might have expected “re-opening” to impact the business. The cloud business continues to show solid growth, with losses narrowing as well, but it still remains number three in terms of size (behind Amazon and Microsoft). Unfortunately there was weakness in the YouTube business, driven by softness in brand advertising following the war in Ukraine as well as competition from TikTok and Apple’s changes to advertising tracking. This proved too much for the market, which sold the company’s shares down -4% after the announcement.

Amazon and Netflix: short-term pain, but huge competitive moats

Elsewhere, the sell-offs were dramatic, especially in Amazon and Netflix (down -14% and -35% respectively). Amazon is facing larger than expected cost pressures, partly due to higher wages across its 1.6m labour force and oil prices (the inflationary pressures everyone will be familiar with) but a larger chunk was due to Amazon building out too much capacity and hiring too many workers. The stock dropped US$460 to US$2400/share on the news.

Netflix disappointed, with management delivering a host of reasons for the weakness in net subscriber additions including password sharing, macro-economic conditions in select regions, more competition and pricing increases. Reed Hastings (CEO) also surprised the market by capitulating on an ad-supported Netflix – this felt like a last minute addition to appease investors and prevent the share price falling as much (it didn’t work). We believe the reaction has been excessively negative. Most company watchers put the addressable market globally at 625m. If Netflix can’t get the phantom 100m to pay up (a charge which will be levied against the primary account holder) it will at least monetise through the introduction of advertising for the freeloaders. Some have fretted about this, but it is no different to the bottom tiers of both Peacock and Hulu, and should help the company tap into regions where Pay TV is less prevalent.

Roku continues to benefit from long-term shift to streaming

Roku managed a much-needed relief rally after delivering earnings results that were better than expected. The company’s entire business has been impacted by supply chain issues; fewer TVs are being sold because input prices have skyrocketed, meaning lower active account growth, while industries where these issues are worse (e.g. autos) have pulled back advertising spend because they don’t have the inventory to sell, meaning lower revenue growth. So Roku’s 39% year-over-year growth in its platform business (mostly advertising) came as a surprise to much of the market. Management also reiterated its full year guidance, which in the current environment highlights the strength of the underlying business. On the longer-term picture, Roku pointed out an important inflection point for streaming TV: its reach – a key metric for many traditional advertisers – surpassed that of legacy pay (linear) TV in the United States. A good sign for those that stand to benefit from this shift like Roku and Netflix.

Qualcomm continues to deliver

Qualcomm also performed very strongly. The company’s forward guidance for the June quarter was significantly higher than expectations, with the read into the September quarter similarly strong. It is unusual to see a company as large as Qualcomm lifting earnings by 68% in a quarter, relative to the same period one year ago. If the company is to be believed there is more to come.

More about the contributor – Loftus Peak invests in companies that will be beneficiaries of the change we expect the world to experience over the next 3 to 5 years. These major secular trends include: Digitisation & Megadata, 5G, Platforms, Networks & eCommerce, Online Advertising, Electrification & Decarbonisation, Connected World, Streaming and Cybersecurity. You can find out more about Loftus Peak here.

Prior to making an investment decision, retail investors should seek advice from their financial adviser. This document is intended as general information only.