This article has been written by an expert contributor, Amit Goel from Fidelity International

Take advantage of shifting global dynamics

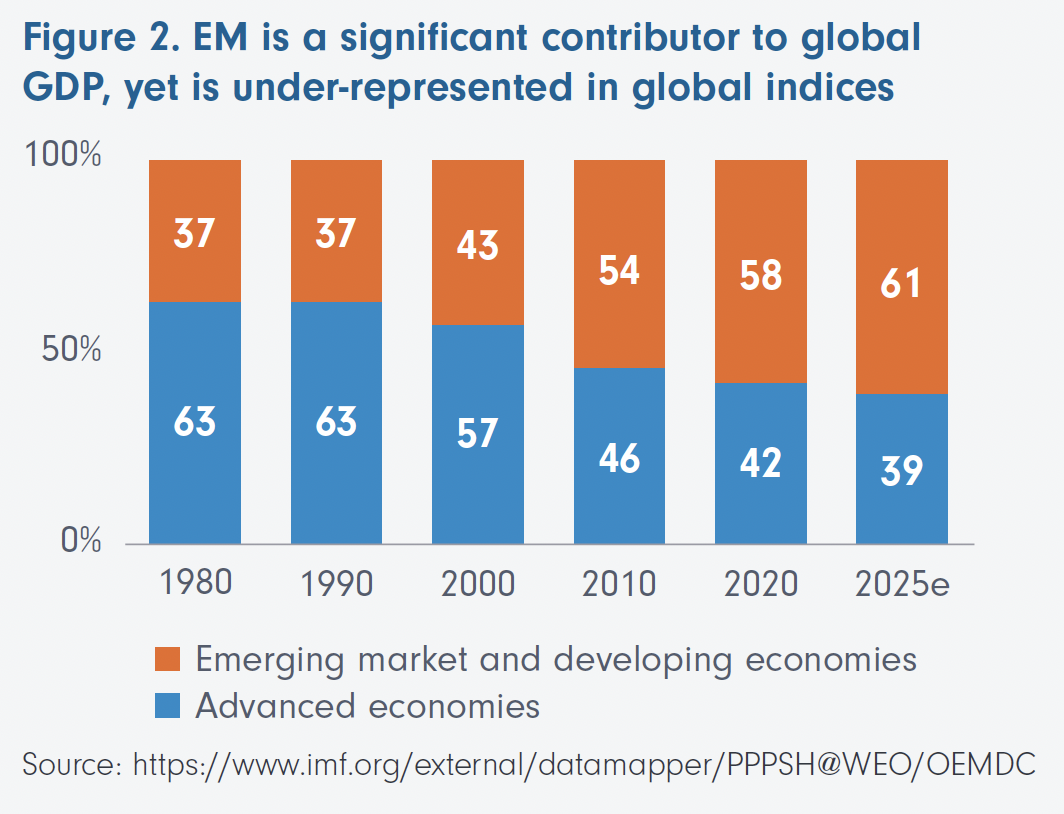

Emerging markets (EM) have been growing rapidly in recent years. In fact, they now contribute over 50% of global growth and are expected to contribute over 60% by 2025.1 Once dominated by agriculture and cheap manufacturing, EM countries are today home to some of the world’s fastest-growing economies and most innovative companies.

Emerging markets poised to benefit from accelerating trends

The rise of the internet and persistent technological advancement have been increasingly important drivers of emerging markets. China, which was traditionally the powerhouse of global manufacturing for decades, today rides the wave of digital innovation with the success of the BAT tech giants – Baidu, Ali Baba and Tencent. Some of the largest e-commerce, gaming, social media and hardware manufacturers reside in emerging markets and the changing nature of the index shows just how much this changed over a decade.

What is an emerging market?

An emerging market economy is simply one transitioning from low-to-middle income to high income. However, unlike a frontier economy, an emerging market economy already shares some of the characteristics of a developed market. This includes a functioning stock exchange where shares can be easily traded, access to debt and some form of predictable government regulation – all of which help smooth its path to development.

EM economies include growing powerhouses such as India, Indonesia, Brazil and China, as well as smaller, more nimble economies like Morocco, the Philippines and Thailand.

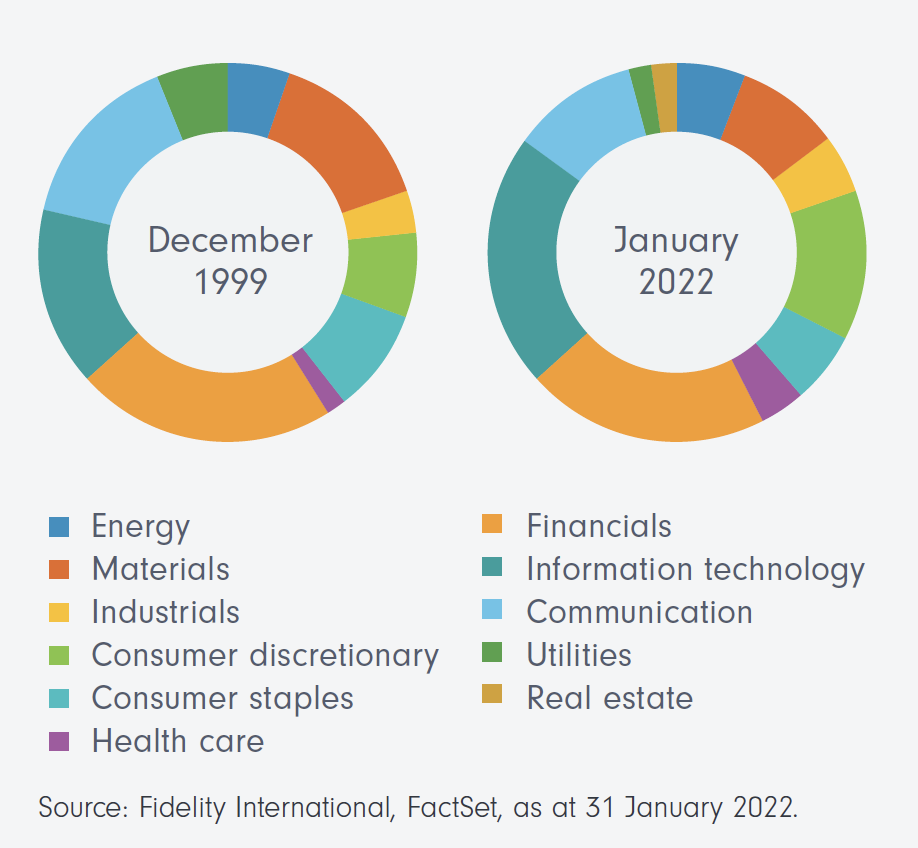

A more broad-based index composition

Since 1999, we have seen a reduction in energy and materials, in favour of tech, consumer and healthcare names. This translates in a less cyclical earning stream.

Figure 1. MSCI Emerging Markets Index composition

Disruptive forces accelerate growth

The COVID-19 pandemic lockdown has accelerated demand for a variety of services and has broadly benefited companies in emerging markets with solid online propositions.

In China, for example, working from home has boosted the need for Cloud services which is in its infancy and ripe for expansion; mobile phone time surged to over five hours per day and time spent gaming on Tencent titles – Honour of Kings and Game for Peace – surged to two to three times the prior monthly run-rate.

With social distancing a feature in many countries for some time to come, this is likely to further accelerate these trends.

Other changes in society and consumer habits will emerge from the pandemic, some semi-permanent and some permanent, such as a greater focus on health, lifestyle choices and financial planning.

Emerging markets, home to large domestic consumer bases, are well positioned to benefit from growth in these themes.

Emerging markets are the growth powerhouse globally

With the changing landscape and growth of emerging markets, emerging market economies are beginning to account for a much higher percentage of global GDP. The IMF World Economic Outlook Database showed that in 1980 these nations had a combined GDP of less than half that of advance economies. By 2010, the two were close to level.

However, by 2025, it’s estimated that emerging economies will have an output that is larger than the developed world (Figure 2). In other words, in the space of 45 years, emerging markets will have gone from a peripheral position in the world economy to a central one. Despite this, they still account for just a fraction of most Australian investment portfolios.

A demographic shift

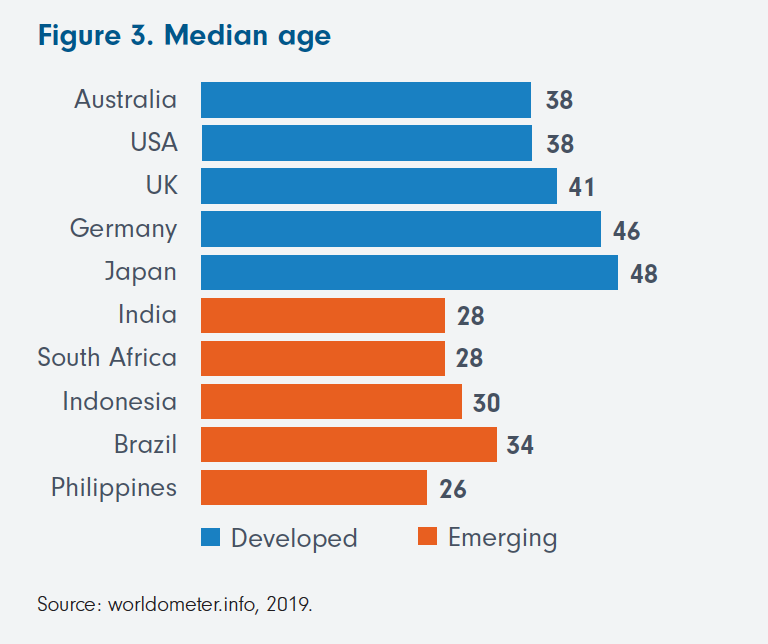

If you’re wondering why emerging markets are experiencing such solid growth, you’ve hit upon the second part of the emerging markets equation – many emerging markets are undergoing a profound demographic shift.

While much of the developed world struggles to come to terms with the cost of supporting an ageing population, developing economies typically don’t have this problem, as much of their population is still young. For example, India’s population has a median age of 27.1 years, compared to the EU’s median of 41.7, which means there are still plenty of productive workers to keep the economy running and fewer retirement-age workers to support.2

As more of these young populations find meaningful work, they also tend to have more disposable income, giving rise to a new middle class in emerging market economies. Between 2009 and 2030, China alone is expected to add 1.2 billion people to its middle class, taking it from < 10% to 73% of its population.3 With this increased affluence comes more consumption – not just of consumer goods such as cars, technology and electrical goods, but of more sophisticated products and services. China’s healthcare industry, for example, grew four-fold between 2006 and 2016.4

From global to regional

With disruption of supply chains during the COVID-19 pandemic, along with geopolitics driving a more regional approach to trade, emerging market economies with large domestic consumption are expected to benefit. We expect to see the rise of regional economic centres, where growing demand from a large economy like China or India, fuels growth in other developing countries nearby. Put this together with strong domestic consumption driven by a rising middle class and the evolution towards growth industries, and we can see a compelling case for exposure to emerging market economies.

The importance of active management

While the case for emerging markets for investors seeking growth and diversification remains strong, selectivity is paramount. Not all emerging markets will emerge on an equal footing from the COVID-19 crisis and regional dislocation is already evident.

North Asia, led by China, has staged a sharp rebound vis-à-vis South Asia whilst in Latin America many countries are still behind the curve in controlling the outbreak and government capacity is limited to compensate for the economic impact.

The recent crisis highlights the importance of investing in high-quality names, characterised by sound balance sheet structures that enable them to weather more challenging environments and come out stronger from the volatility than their peers. Solid corporate governance and underlying incentive structures are also paramount, to ensure businesses treat capital prudently and try to grow shareholder value over time.

An active investment approach offers crucial advantages for investors as it allows our investment team to select opportunities from a much broader universe than those available in the Index. The advantage to investors is twofold: greater diversification across countries, sectors and companies, and importantly enables us to choose our investments selectively taking into account the varying impact of the crisis on emerging market economies, the sectors and the companies themselves.

To learn more about what Emerging Markets are then check out this infographic: What are emerging markets?

To see a high-level snapshot of some of the companies held in the Fidelity Emerging Market portfolio check out this article: Fidelity Global Emerging Markets Fund – Top 10 positions

The author, Amit Goel joined us on the Equity Mates Investing Podcast on 01/09/22. Check it out here: Expert: Amit Goel – This company buys 13% of all Brazilian cars | Fidelity

Sources:

1. https://www.imf.org/external/datamapper/PPPSH@WEO/OEMDC

2. https://www.worldometers.info/world-population

3. https://www.brookings.edu/wp-content/uploads/2020/10/FP_20201012_china_middle_class_kharas_dooley.pdf

4. www.mckinsey.com

Access Fidelity’s best ideas in emerging markets. Amit Goel, the Lead Portfolio Manager for the Fidelity Asia Fund and Punam Sharma, the Co-Portfolio Manager for the Fidelity Global Emerging Markets Fund are backed by a 400-strong team of investment professionals worldwide.

They carefully select 30 to 50 companies they believe are well positioned to generate returns through market cycles and which have demonstrated a track record of strong corporate governance. Recommended as a long-term holding (minimum investment time period of five years plus).

Established in 1969, Fidelity International offers world class investment solutions and retirement expertise. As a privately owned, independent company, investment is our only business. We are driven by the needs of our clients, not by shareholders. Our vision is to deliver innovative client solutions for a better financial future.

Prior to making an investment decision, retail investors should seek advice from their financial adviser. This document is intended as general information only.