This article has been written by an expert contributor, Jack Manley, Global Market Strategist, J.P. Morgan Asset Management.

These financial institutions would incorporate FedNow into their existing transfer infrastructure, so consumers, businesses and non-bank payment providers would use the system indirectly, rather than treat it as a third-party application.

On March 15, the Federal Reserve announced a new payment service called FedNow. Shortly thereafter, claims began to circulate that FedNow is tantamount to a central bank digital currency, or CBDC. The announcement came roughly a year after President Biden signed an executive order tasking the Federal Reserve with looking into a CBDC for the U.S. financial system.

Concerns around a U.S. CBDC are centered around privacy, as a digital U.S. dollar would, in theory, eliminate the anonymity associated with cash transactions and create a framework for government intervention into private financial dealings. A CBDC also has the potential to disintermediate commercial banks in portions of the financial system, thereby concentrating more power with the Fed.

However, FedNow is not a CBDC, and in fact Congress has not passed a law authorizing the Fed to issue a CBDC. Instead, FedNow should be considered a new payments infrastructure, complementing existing Fed payments systems, to be layered into the U.S. financial system. As a result, it is not an alternative or threat to the U.S. dollar.

Standard online cash transfers typically operate through the Automated Clearing House Network, or ACH. ACH transfers are processed in batches rather than individually and can take multiple business days to complete. FedNow, by contrast, will enable customers at participating banks and credit unions – and participation is voluntary – to send money near-instantly, at any time of day and on weekends and holidays. These financial institutions would incorporate FedNow into their existing transfer infrastructure, so consumers, businesses and non-bank payment providers would use the system indirectly, rather than treat it as a third-party application.

For consumers, the introduction of FedNow will likely improve financial “hygiene”: there is little risk of overdrawing a bank account because member-banks will no longer have to verify sufficient funds before issuing transfers. It may also reduce the “stickiness” of deposits in low-yielding cash accounts, as money could be moved in a much more convenient manner between accounts. Businesses that manage payrolls and vendor relationships would also benefit from enhanced fluidity of their dollars.

The dollar is, of course, well-worth talking about, as its current strength drags on U.S. economic growth and the profitability of multinational U.S. companies while providing the U.S. government with an inexpensive source of borrowing and political power on the global stage. Questions around U.S. dollar strength are myriad and having a view on where the U.S. dollar will move from here is critical to portfolio positioning, especially for those investors looking to take advantage of strong overseas markets. However, for individuals worried about a potential U.S. CBDC with the FedNow announcement, these concerns are misplaced, at least for now.

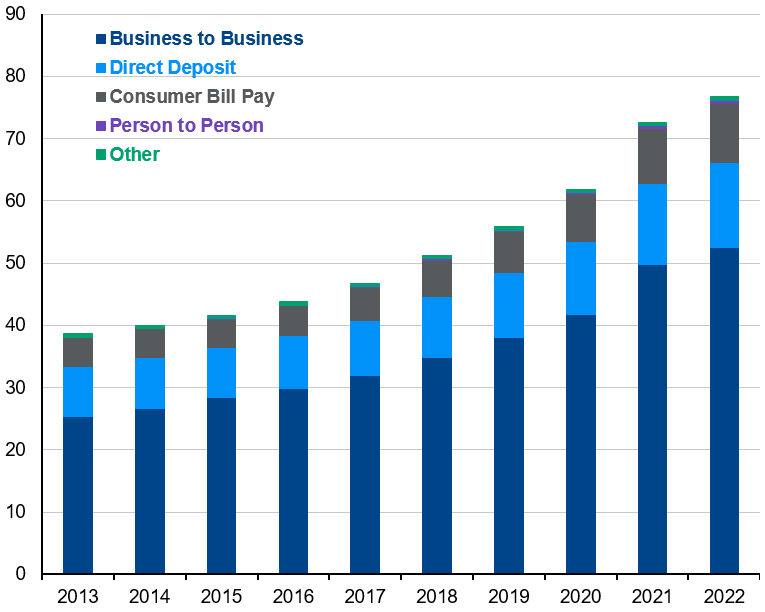

ACH network growth

Value of ACH payments by type, USD trillions

Source: Nacha, J.P. Morgan Asset Management. Data are as of April 13, 2023.

Prior to making an investment decision, retail investors should seek advice from their financial adviser. This document is intended as general information only.