This article has been written by expert contributor Steve Johnson, Forager.

Yes, yes, I get they are cheap. But when, if ever, will small caps start working? Midway through what’s looking like another year of small-cap underperformance, that’s the question many long-suffering investors are asking.

Of course, the old quote financial markets saying attributed (incorrectly) to John Maynard Keynes is usually the answer to questions like this: the market can stay irrational longer than you can stay solvent.

A few recent anecdotes, however, suggest the answer might be sooner than that.

A couple of weeks ago, one of our favourite international small caps announced its worst quarterly result in almost three years. Open Lending (NASDAQ: LPRO) earns revenue by arranging finance insurance on second-hand cars in the US. That market was pummelled by a lack of new car supply, then falling used car prices and, more recently, a dramatic increase in interest rates. Compared with the second quarter of 2021, the company arranged 30% fewer loans and its profitability more than halved. Open Lending’s share price is up over 40% so far this month.

Another important investment in our International Fund, Janus International (NASDAQ: JBI), is having a much better time of it. It reported record first-quarter profits, up 45% on the previous year thanks to a 10% increase in revenue and improving profitability. The company is the dominant manufacturer and installer of self-storage facilities in the US and has a rapidly growing international operation, including here in Australia. It says its pipeline of work remains healthy and expects record revenue and profits for the 2023 year.

Janus’s share price has fallen 14% since the end of February and the bumper result did nothing to change investor sentiment.

Maybe Janus needs to take a leaf out of Open Lending’s book and start announcing some downgrades? Seriously, maybe that’s exactly what needs to happen.

Everyone knows there is a slowdown coming in the self-storage construction sector. Janus’s customers (often specialist listed property trusts) rely on people renting storage space while they move houses. Covid was a boon. The subsequent housing slowdown is obviously going to put the breaks on. No one (except us, it seems) wants to own Janus before the slowdown arrives and, the better the reported results, the more convinced everyone seems to get that the coming correction is only a matter of time.

For Open Lending, the first quarter results suggested that this is as bad as it gets. Almost 40% of the loans it arranged were refinancings in the first quarter of 2022. Thanks to rapidly rising rates, this year they represented less than 8% of the business. It can’t be any worse than zero. Meanwhile, its core business has been growing sequentially for the past few quarters. Now that prospective investors can see a path out of the valley, they have come rushing back to the stock (the share price is still down 75% from its 2021 peak).

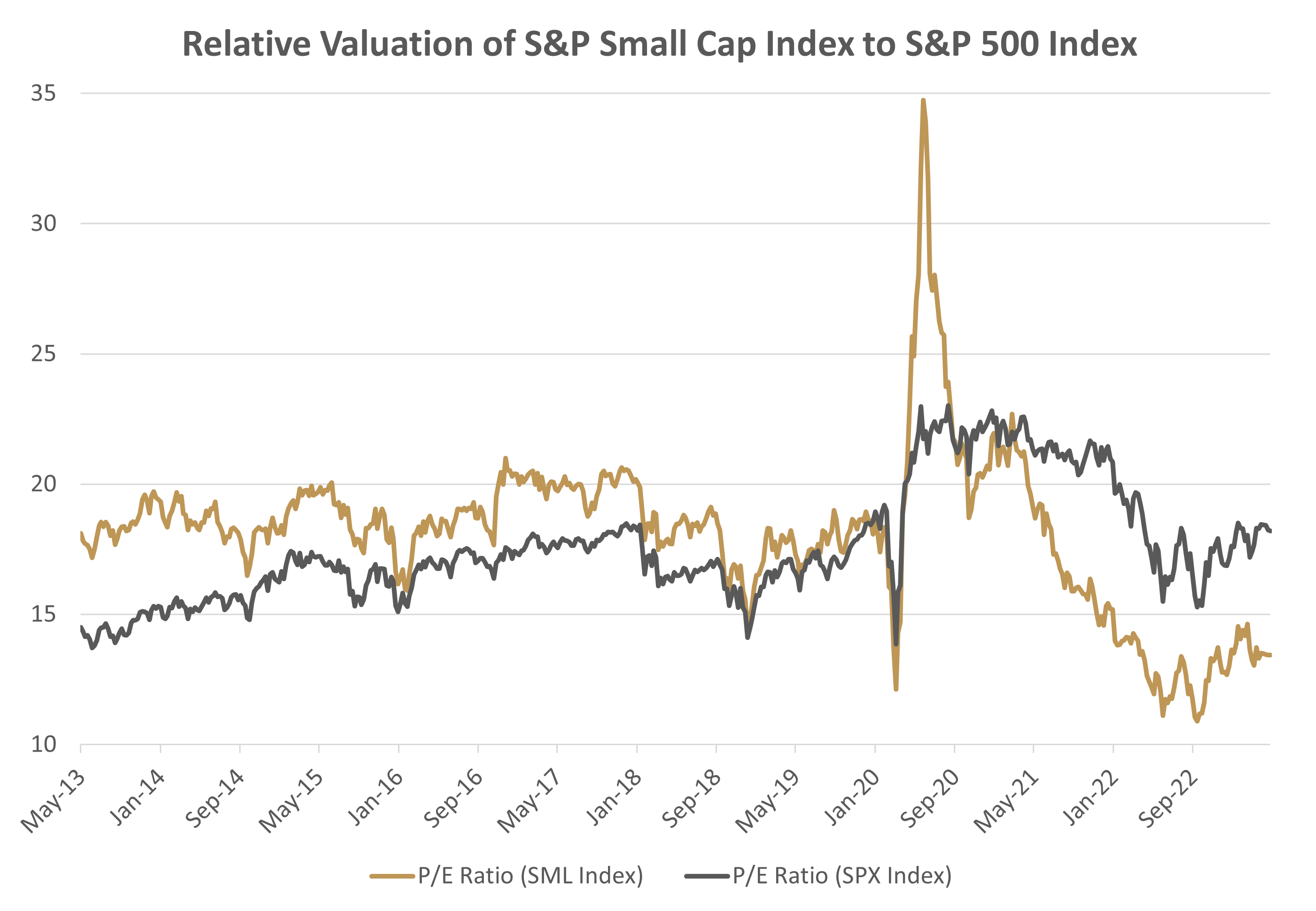

I think the same will be true of the wider small-cap malaise. Potential investors are petrified about a recession that hasn’t yet arrived. No one knows how bad it will be or how long it will last. In the US, relative valuations for small caps are at their lowest levels on record. This is partly because large caps are expensive but also because small caps are cheap.

Source: Bloomberg

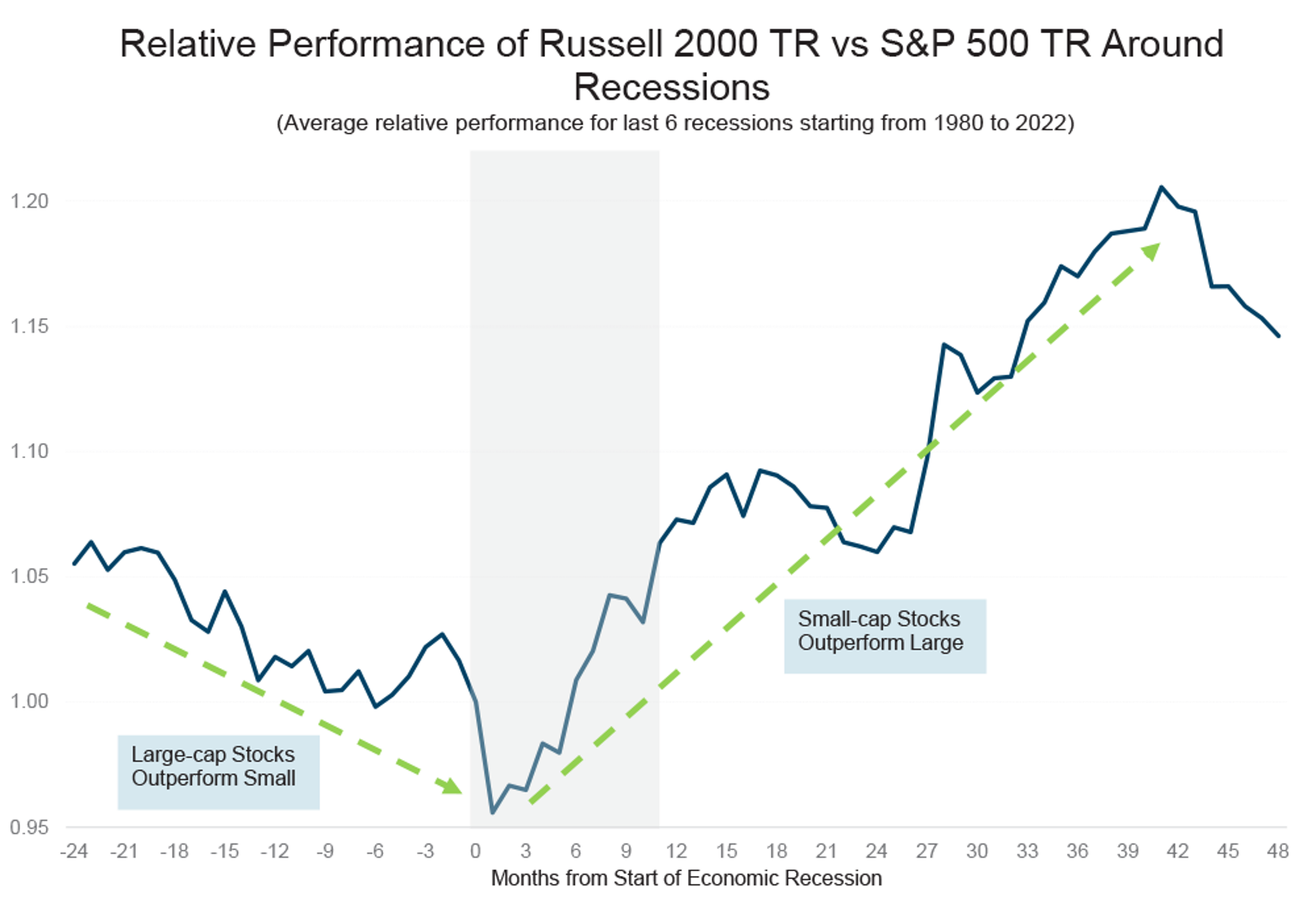

As the Open Lending example shows, sentiment can improve long before results. Once a recession arrives, people very quickly start looking to the other side. A recent article by Global Alpha presented data showing small-cap performance into and out of the six most recent US recessions. It won’t surprise anyone that there was underperformance prior to an economic contraction. But it surprised me that small-cap stocks started working quickly once a recession arrived. Within one month of historical recessions starting, small caps started outperforming. And the outperformance lasted three years.

Source: Global Alpha Capital

Past performance is no guarantee of future performance. But maybe there is an answer to the question, when will small caps start to work? It is the recession we have to have.