This article has been written by expert contributor, Alexis Gray, Senior Economist, Vanguard Australia.

2023 – Getting on top of Inflation

2022 has probably felt like a relentless rollercoaster ride to most investors. At time of writing, the Australian investment scorecard for 2022 was marking -0.27% return for equities1 and -8.31% for fixed income2, while global shares and fixed income were delivering double digit negative returns.3

While we entered the year with cautious optimism and celebrated our return to ‘normal’, events like the Ukraine war and subsequent increased pressure on supply chains upended that new year enthusiasm, translating to a more downbeat mood in financial markets and among consumers.

Conversations for most of the year have centred on the cost of living, and inflation will likely be 2022’s buzzword. For investors, a topic that loomed large was the deviation of the inverse relationship between equities and bonds, causing further worry and pain for many.

But those considering a move away from using bonds as a ballast in a portfolio should understand that it is rare for both equities and bonds to deliver negative returns concurrently for protracted periods. In fact, data tells us that since 1995, the simultaneous decline in both global shares and bonds have on average, occurred less than 13 per cent of the time or in other words, a month of joint negative returns every seven months or so. Thus, it follows that joint declines in both asset classes at the same time is an anomaly and unlikely to persist. That said, given the typical driver of this situation is an unexpected surge in inflation, a further shock to global energy prices could trigger a repeat of 2022.

Looking ahead to 2023, our forecasts suggest that the fight against inflation needs to persist, and policymakers will continue to raise interest rates to lessen the inflationary push from elevated demand.

Vanguard modelling anticipates a 40% chance of a recession in Australia, a base case scenario that is far lower than the 90% odds placed on U.S., U.K., and Euro area recessions. This is because while inflation and wage pressures have affected many Australians, we are, relatively speaking, in a better position than many other developed economies, thus interest rates need not rise as much. We also stand to benefit from a cyclical rebound in China, and as a net exporter of commodities given elevated commodity prices.

We project growth in 2023 to land very weak or slightly negative in most major economies outside of China. Unemployment numbers will likely rise, but probably nowhere near as high as during the 2008 and 2020 downturns. And as a result of job losses and slowing consumer demand, a downtrend in inflation is likely to persist through 2023.

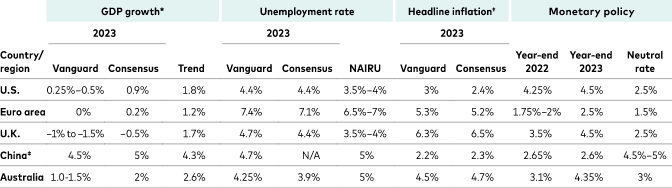

Vanguard’s economic forecasts

Returns in equity and fixed income markets

In Australia, we expect the cash rate to reach 4.35% by mid-2023, higher than currently anticipated by markets and economists, given the RBA’s strong desire to quash inflation. The rapid and continued interest rates rises have been painful in the near-term but higher starting interest rates have raised our return expectations significantly for global bonds.

Vanguard now expects Australian bonds to return 3.7%–4.7% per year over the next decade, compared with the 0.9%–1.9% annual returns forecast a year ago. Global bonds are anticipated to return 3.9%–4.9% per year over the next decade, higher than compared with our year-ago forecast of 1.3%–2.3% per year.

In equity markets, a fall in valuations mean the outlook has also improved. From an Australian dollar investor’s perspective, Vanguard’s rolling 10-year forecasts project higher 10-year annualised returns for ex-Australia markets (5.6%–7.6%) than for Australian equities (4.5%–6.5%). Outside of Australia, our equity return expectations are 2.5 percentage points higher than they were at this time last year.

To adjust or to stay the course?

2022 has been trying even for the most experienced of investors but the good news is that both equities and fixed income are now a lot more attractively priced than where we were at the end of 2021.

Investors thinking of implementing portfolio changes based on the likelihood of a possible recession in Australia – and elsewhere – should consider maintaining a focus on their long-term investment plan if their long-term goals have not changed.

For some, forecasts about possible recessions could very well change short-term financial goals and plans and thus asset allocation decisions should be made accordingly. But for those with a long-term horizon, Vanguard’s rolling 10-year asset class return outlooks should be used to help set realistic expectations and to inform a long-term plan, rather than spur tactical decisions over the short-term. Afterall, the truism that ‘time in the market’ beats ‘timing the market’ is rooted in the basis that being fully invested tends to outperform sitting on the sidelines while waiting for the market to bottom.

Markets are generally forward looking and a 2023 recession is already in part reflected in asset prices. Thus, re-allocating assets based on forecasts such as these are unlikely to bear fruit unless the outlook deteriorates further. And, needless to say, market timing is challenging, even for professional investors, given the difficulty of consistently predicting market moves while keep transactions (and associated costs) down.

Regardless of whether we land in recession-territory, or whether bonds and/or equities continue to contract in 2023, reacting to current events and using short-term portfolio performance as a focal point to make investment strategy decisions can be detrimental for investors.

Knowing when the market will hit the bottom is difficult and because valuations are now more attractive, those who stay invested in the market are more likely to be rewarded when the volatility ebbs.

An iteration of this article was first published in the ASX newsletter on 2 December 2022.

Alexis Gray, MSc, is a senior economist in the Vanguard Investment Strategy Group, a global research team which develops multi-asset-class allocation strategies and conducts research on the capital markets, the global economy, portfolio construction, and related investment topics.

Alexis also regularly serves as an ambassador for Vanguard, speaking at client events and industry conferences on a range of topics, and has authored numerous research papers on macroeconomics and investment issues. Learn more about Vanguard here.

The above material has been republished with the permission of Vanguard Investments Australia Ltd.