Uncovered is our exploration of the companies that don’t receive as much media attention or analyst coverage. We believe every company has an interesting story and we want to hear them.

Come join us and expand your view of what is possible as we uncover the uncovered.

This page contains sponsored content.

Share price is accurate as of time of writing. Past performance is no indication of future performance.

Welcome to the world of computer memory. Here’s what you need to know from the outset: there are two main types of computer memory that are used in most of our devices.

- DRAM, or dynamic random-access memory, is a type of semiconductor memory that is fast, flexible and temporary. It is best used for processing data and running applications. It loses data when power is taken away.

- NAND Flash memory is ideal for large, stable and permanent storage such as storing data and files. It stores data even when power is taken away.

Most of our devices operate on these two forms of memory. But there are other potential options which may sit alongside these. One is called ReRAM, or Resistive Random-Access Memory, and 4DS ReRAM is considered a potential ‘in between’ DRAM and Flash. ReRAM has had a mixed business history, but 4DS Memory are working on new technology that they believe will usher in the next generation of ReRAM memory.

ReRam: A history

For years, ReRAM was seen as offering lower read latency and a faster write performance. However, it has been far more difficult to develop than experts initially expected.

Some of the largest technology companies in the world have worked on ReRAM products. Hewlett-Packard observed one type of ReRam, dubbed the memristor. For years, HP was developing a futuristic ReRAM system called “The Machine”. Separately, HP teamed up with Western Digital to develop another ReRAM technology. Sony and Micron partnered to co-develop ReRAM, until Micron backed out to work on another technology.

As a result of these challenges, only a few companies have shipped ReRAM in any meaningful volume.

Despite the development troubles, the industry is still searching for a new memory type or storage class like 4DS ReRAM, that fits between main memory (DRAM) and storage (NAND Flash).

The market for memory is growing

Every year, our computers and phones are constantly improving and offering better performance and more storage.

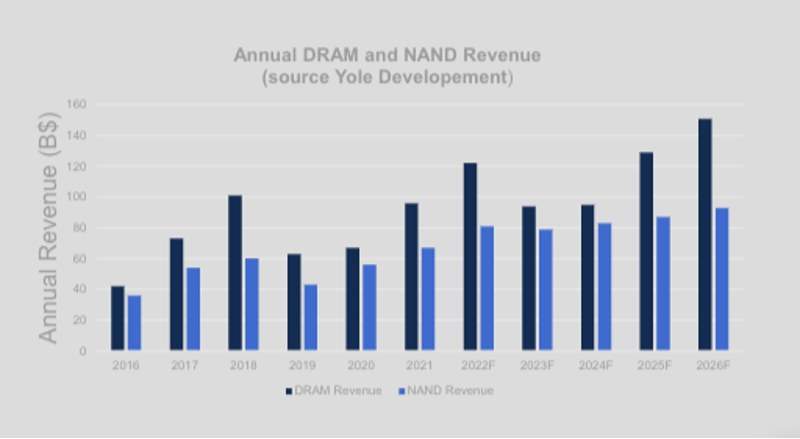

Underpinning all of that is the growing memory market. Today, DRAM is bringing in more than US$100 billion a year, and NAND Flash is more than US$60 billion.

After these two large segments – DRAM and NAND Flash – the market tails off. The third biggest segment is NOR Flash at less than US$3 billion.

The industry is calling out for a third-solution between DRAM and NAND Flash and yet, to date, no one has been able to get the technology right.

4DS believe they may have a solution

4DS have been working on a new form of area-based ReRAM technology. And they believe this approach may solve many of the challenges the industry has been facing for years.

The company owns a portfolio of 34 USA patents granted, which have been developed in house to create high-density Storage Class Memory.

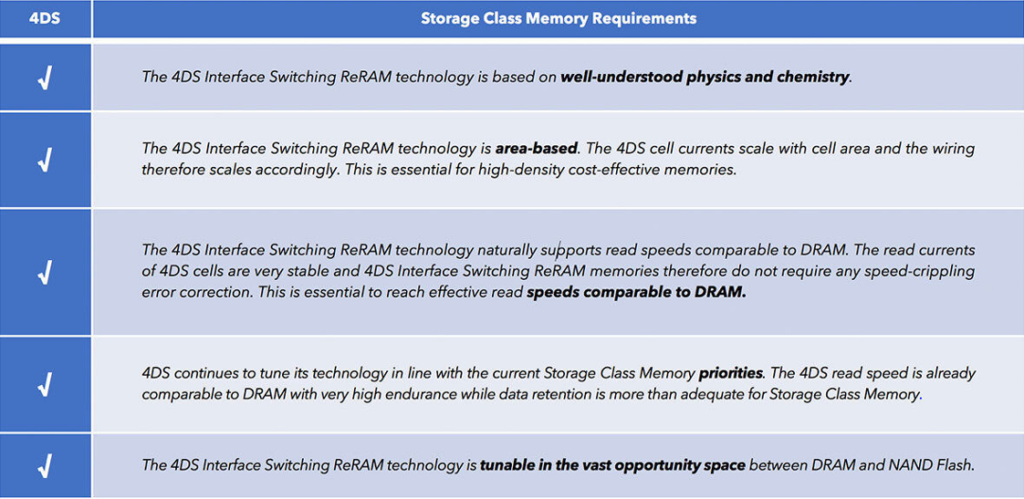

4DS believe that their Interface Switching ReRam ticks a number of boxes for the industry:

Recent positive results

For years, 4DS has collaborated with imec, a world-leading research and innovation hub in nanoelectronics and digital technologies. Earlier this year, 4DS tested their latest memory cells on imec’s equipment.

The results of these tests were made public in August 2023 with further significant results released in September 2023. Within a fully functioning megabit array with 60nm memory cells, their testing confirmed:

- Write speeds at 9.5 nanoseconds, which significantly outperforms DRAM write speed

- Endurance well in excess of 3 billion cycles

- Verified equivalent DRAM read speed

- Verified persistent memory with variable and tuneable retention

For the non-technical readers, basically, 4DS was able to demonstrate ReRAM performance that many of the large tech companies had only dreamt about for years. Or, as the company’s ASX release announcing the results put it, “the results obtained are significantly better than the Board and management team at 4DS were expecting”.

These results saw the 4DS share price jump 350% in a matter of days. The market was excited for these results.

Where to from here?

The industry is calling out for new memory options, with estimates that the emerging-memory market will be US$44 billion by 2032. 4DS ReRAM is seen as potentially one complimentary technology to DRAM.

4DS’ results will have made the industry sit up and take notice. The team are currently speaking to imec about further proving their technology and next steps. If they are able to show that they’ve solved some of the challenges previous ReRAM efforts couldn’t overcome, then this small ASX-listed company may have just taken the next important step forward in computer memory technology.