This article has been written by expert contributors from J.P. Morgan Asset Management.

“China’s reopening rebound will be largely driven by consumption rather than investment, which means this rebound will be concentrated in consumer sensitive sectors, tourism, and retail markets. “

In brief

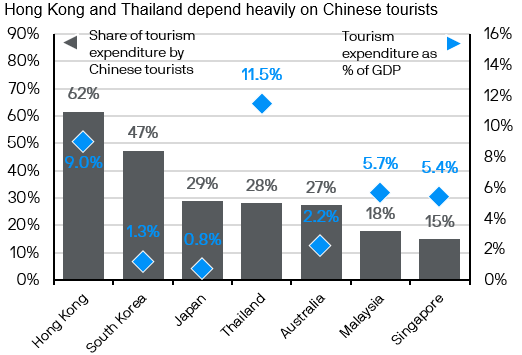

- The return of Chinese tourist to the Asian region and the unwinding of pent-up savings will serve as a positive tailwind for economies such as Hong Kong and Thailand.

- From a trade perspective, China’s recovery can cushion Asia exports against a global downturn. Hong Kong and Singapore have the highest exposure to China’s final demand. China’s recovery can also benefit commodity exporting economies such as Malaysia, Indonesia and Australia.

- The alleviation of supply chain pressures will be disinflationary, but a potential pickup in manufacturing and construction activity could tighten commodity markets further. A fall in demand in the U.S. and Europe will offset some of this impact.

China’s domestic reopening is taking place earlier and at a much faster pace than expected, with important implications on consumption, exports, supply chains and commodity prices.

The return of Chinese tourism

Over the pandemic, restrictions and concerns over the economic outlook led to a pickup in savings rate in China, averaging 33% between 1Q20 to 3Q22, more than 4 percentage points higher than the average between 2015 to 2019. This implies a substantial amount of pent-up demand and savings will be released both domestically and abroad as Chinese travelers move in and out of the country without the hurdles of quarantines and mass-testing.

In 2019, more than 150 million Chinese travelled abroad and spent an aggregate amount of 255 billion U.S. dollars – accounting for around 17% of global outbound travel market. In APAC, Hong Kong and Thailand will benefit the most from the return of Chinese tourists, where Chinese tourist expenditure were equivalent to 5.6% and 3.2% of their respective nominal Gross Domestic Product (GDP) in 2019. In other economies such as Japan and Korea, although tourism only makes up a small proportion of GDP, nonetheless, spending by Chinese tourists will be key in propping up demand for services in these economies as Chinese travelers made up more than 40% of inbound tourists in 2019.

Since the end of November, the number of international flights from China have risen by more than 20%. The number of tourist arrivals in various APAC countries still sit at around 50% of levels in 2019, meaning there is plenty of room for further recovery, which would create positive knock-on effects on business and consumer sentiments, supporting private consumption and offsetting some impact from recessionary concerns in the U.S. and Europe.

Impact on trade and good exports

China’s economic slowdown in 2022 was no doubt a headwind on the region’s export momentum, with Asia ex-China’s export growth to China falling into contractionary territory year-over-year starting mid-2022, while export growth to the U.S. and Europe held up at high single-digit growth. This trend is likely to reverse if demand turns sour in the U.S. and Europe this year, while China’s recovery can cushion Asia exports against a global downturn.

Exhibit 1: Dependence on tourism

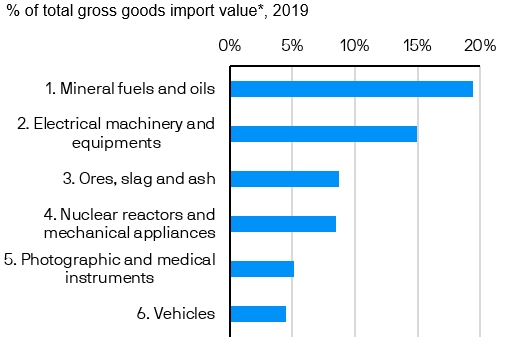

Exhibit 2: China’s top imported goods

Source: (Exhibit 1) CEIC, FactSet, Development of Tourism Thailand, General Statistics Office Vietnam, Tourism Malaysia, Korea Tourism Organization, Tourism Research Australia, Hong Kong Tourism Board, Singapore Tourism Board, Japan National Tourist Organization; (Exhibit 2) OECD TiVA database; J.P. Morgan Asset Management. Data reflects most recently available as of 06/01/23.

As a global manufacturing hub, the Organization for Economic Cooperation and Development (OECD) estimates around 30% of China’s imports are intermediate goods and services, thus headline export numbers to China can be misleading. Looking at various economies’ value-added exposures to final demand in China reveals that a Chinese recovery in China can benefit Hong Kong and Singapore the most, with both having over 25% exposure to China’s final demand. Meanwhile, Malaysia and Philippines are similarly exposed to China’s final demand as they are to that of U.S. and European Union combined, thus, a slowdown in the West might partially offset trade gains from China’s recovery.

In terms of gross goods imports, nearly 20% of that is in mineral fuels and oils. While the majority of imports come from Russia and Saudi Arabia, given China’s size, a recovery will still be a major tailwind for Asia’s commodity exporters such as Indonesia and Malaysia. 45% of China’s ores, slag and ash imports come from Australia, but while iron ore demand has held up in 2022 from Chinese government’s infrastructure investments, a rebound in China’s property market will be key to sustain export growth from Australia to China. Outside commodities, China imports a lot of electronics from Korea, Japan and Taiwan. However, they are mostly re-exports, which are more dependent on global demand than China’s domestic demand.

Having said that, we’ve learned from Western countries that services, rather than goods, are the key driver of post-COVID recovery, so the pass-through from China’s recovery into import growth might be more muted than past cycles.

Inflationary or disinflationary?

Given China’s important role in the global supply chain ecosystem, the reopening will have an impact on the global inflation dynamic.

From a supply chain perspective, the long run effect of reopening will be a continued alleviation of supply chain bottlenecks as manufacturing and shipping activities normalize further. At the height of the pandemic, freight costs ballooned to 10 times that of pre-pandemic levels, but since then, costs have slowly normalized. While shipping costs from China to the rest of the world are still up by more than 30%, we should get some further easing of supply chain bottlenecks as infections peak and decline. This will help push global inflation down.

The reopening of China will also have implications in the commodity market. Between 2021 to 2022, China’s import of crude oil declined by 4% year-over-year (y/y) on average every month, much lower than the monthly average 12% y/y increase in 2019. Should Chinese demand for oil pick up, this could worsen the supply shortage and squeeze prices higher if the Organization of the Petroleum Exporting Countries or other producers refuse to raise oil production. A revival in construction starts could also raise the demand for commodities such as iron ore and cement. That said, China’s housing activity will likely remain weak, amid weak income expectations as well as sluggish house price expectations coupled with ongoing concerns about home delivery. Moreover, these inflationary forces could, to a large extent, be offset by the decline in demand from the U.S. and Europe.

Investment Implications

China’s reopening rebound will be largely driven by consumption rather than investment, which means this rebound will be concentrated in consumer sensitive sectors, tourism, and retail markets. Asian economies such as Hong Kong, Thailand will be key beneficiaries. Commodity prices will also receive some near-term support which will benefit economies such as Malaysia, Indonesia and Australia.

Despite the recent rally, we remain constructive on Chinese equities given the recent positive turn in the policy environment. On top of compelling valuations, we think this presents itself a relatively attractive entry point for longer term investors. The A-shares market also continue to remain less correlated with global indices which will provide a good hedge against a downturn in the U.S. and Europe.

The J.P Morgan Asset Management Market Insights program provides comprehensive data and commentary on global markets without reference to products. Designed as a tool to help clients understand the markets and support investment decision-making, the program explores the implications of current economic data and changing market conditions.

This document is a general communication being provided for informational purposes only. Prior to making an investment decision, retail investors should seek advice from their financial adviser. This document is intended as general information only.