This article has been written by an expert contributor Munro Partners.

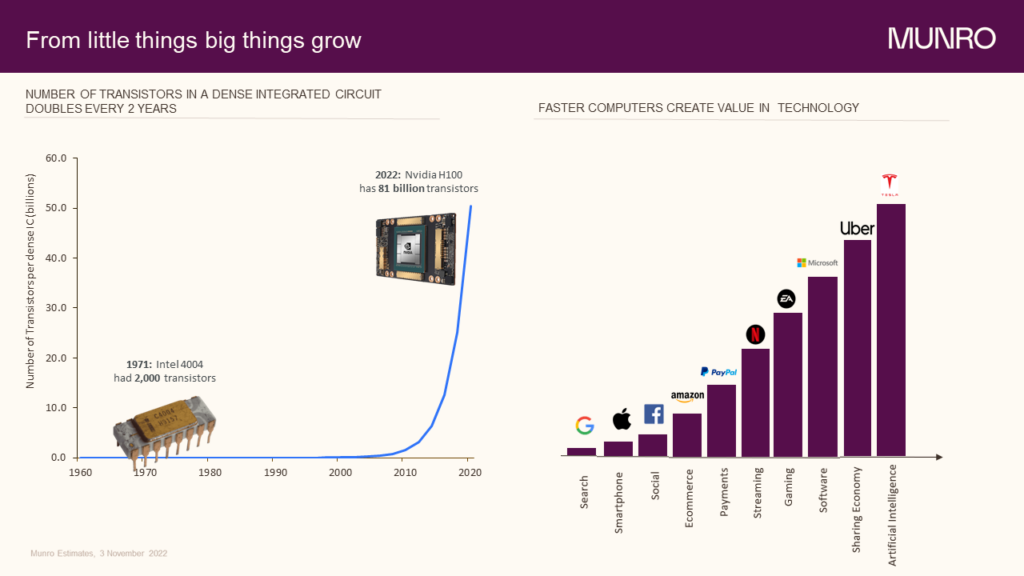

ASML is producer of semi-conductor manufacturing tools, specifically leading-edge lithography tools. ASML’s tools are essentially extremely advanced stencils that use extreme ultraviolet light to allow the miniaturisation of semiconductors, or Moore’s Law, to continue. This process of shrinkage has been the key enabler of technological advancement in the modern world, and over time ASML has become a monopoly in high end lithography.

ASML’s performance in the quarter was driven by the arrival of the company’s capital markets day in November 2022. On this investor day, there was a meaningful focus on the company’s growth and growth drivers going forward. Management significantly upgraded their target model for 2025 and 2030, driven by demand for high end semiconductors. The company now estimates sales of €30bn – €40bn by 2025, a significant upgrade from last year’s guide of €24 – €30bn. With gross margins and operating model held constant, this implies an EPS range of €29 – €42 by 2025 versus previously implied €22 – €28. For 2030, management increased their sales expectation from €40bn to €44 – €60bn, implying a new EPS range of €42 – €68. The 2025 revenue guide increase came from stronger EUV and DUV sales due to higher uptake rates, tech sovereignty and the insatiable demand for more compute power. Their 2030 upgrade comes almost entirely from raised assumptions on demand for High NA EUV tools.

Assuming the company hits an EPS of approximately €14 in FY22, the midpoint of the company guide for FY25 / FY30 implies a compound annual earnings growth rate of 35% and 18% respectively. Alternatively put, the stock trades on 14x and 10x their FY25 & FY30 midpoint guides. It’s clear that the current market value being ascribed to future growth potential is undervalued and we’ve accordingly used stock price weakness to increase exposure through the quarter.

Disclaimer: The material contained in this publication has been furnished for general information purposes only as is not investment advice of any nature. The companies mentioned are for illustrative purposes only, is not a recommendation and may or may not be held by a Munro fund. There can be no guarantee that any projection, forecast or opinion in these materials will be realised. As an actively managed fund, Munro continually assesses each portfolio holding and the views expressed in this document may change at any time subsequent to the date of issue. This information has been prepared without taking account of the objectives, financial situation or needs of individuals. No representation or warranty is made concerning the accuracy of any data contained in this document.

Prior to making an investment decision, retail investors should seek advice from their financial adviser. This document is intended as general information only.