This article has been written by an expert contributor, Fidelity International

In a volatile market, diversification is key

In an uncertain market, diversification across different asset classes, countries, sectors and regions is paramount. Global shares offer diversification across sectors and themes that would not be possible to achieve by investing in Australian equities alone.

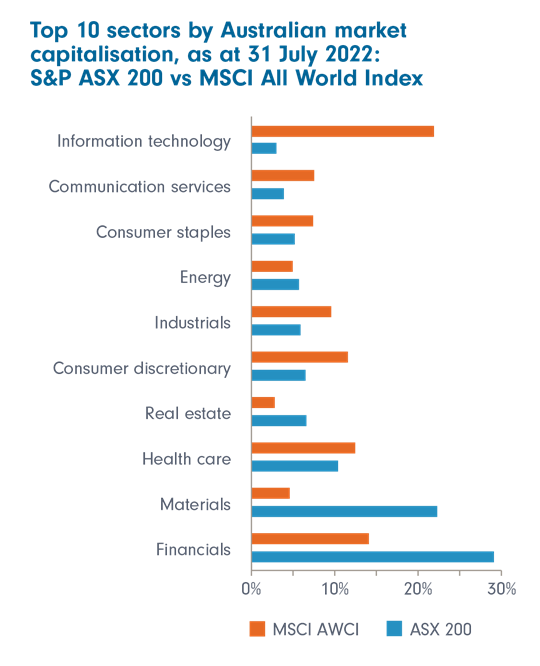

The ASX 200 was traditionally dominated by two industries and, for the last twenty years, financials and materials accounted for roughly half of the ASX by market capitalisation.

More recently, healthcare has had a larger presence in Australia, with the healthcare sector representing approximately 10% of the ASX 200, after strong growth in 2020 and 2021.

While this relatively recent change in sector composition has helped to reduce concentration risk, if you only invest in Australian shares you may miss out on meaningful exposure to sectors such as information technology and consumer discretionary, just to name a few.

Staying domestic may also mean missing out on opportunities to be found among small to mid-cap global companies. By focusing on bottom-up research to find companies in their earlier stages of growth offers investors a way to gain exposure to the diverse small and mid-cap (SMID) category.

A potential world of opportunity

When we think of global companies, we often think of the mega companies such as Apple and Amazon but there’s potentially a whole world out there with many diverse opportunities, many of which we’re less familiar with such as:

- Taiwan Semiconductor Manufacturing Company (TSMC), a global leading semiconductor foundry, has been at the forefront of chip design since the early 1980s and today is the leading manufacturer of cutting-edge microchips for some of the largest companies in the world. Its most important customer is Apple, who use TSMC’s nanochips in their iPhone, iPad and Mac production. In 2020, over US$48 billion revenue for TSMC was directly attributed to Apple.

- Tencent Holdings Ltd, currently the largest social network company in China, provides online games, digital content, online advertising services and other internet related services. Since 2017, Tencent has worked in partnership with Nintendo. Before this, Nintendo had relatively limited business in China, but since announcing the partnership, Nintendo shares rose 7.1% to a nine-year high. In 2019, Tencent had exclusive rights to launch the Nintendo Switch in China, which up until that point had not been available in the region.

- LVMH, a French global luxury group active across six sectors: wines and spirits, fashion and leather goods, perfumes and cosmetics, watches and jewellery, selective retailing and other activities. LVMH’s portfolio of brands offers good diversity and less cyclicality compared to peers. The company has delivered consistently high returns on capital and has one of the best management teams in the sector. Emerging middle-class expansion remains a key engine of growth for the business, as consumers ‘trade up’ as their incomes rise.

Investing in companies from diverse sectors and regions such as these, not only has the potential to generate higher returns, it can also help mitigate risk and cushion portfolios against periods of volatility.

Investing globally may be easier than you think

Global shares also offer diversification across sectors and market capitalisation that would not be possible to achieve by investing in Australian equities alone. With more than 58,0001 listed companies on stock exchanges worldwide, investing globally can feel too big, or too risky and complicated. But it doesn’t have to be; in fact, access to international markets may be easier than you think.

As with investing in Australia, there are two options to investing overseas: direct and indirect. Direct investing is where you purchase an asset under your own name, such as shares, but the shares are located in another country. While this gives you freedom and control to manage your investment, you will also need to be aware of the laws, regulations and rules that apply in the country in which you’re invested, as well as in Australia when you collect your returns or dispose of your shares. Different jurisdictions have different legal systems which may be difficult to navigate if you haven’t done your research first.

Another option is indirect investing via a managed fund or Active ETF. This is a simpler way of gaining foreign exposure, as you are investing in a fund that has a portfolio manager responsible for picking and choosing assets as well as the overall management of the fund. This style of global investment can sit alongside your Australian investments and may be worth considering if you’re in search of growth sectors or themes not available in Australia.

Source: 1 – Number of Listed Companies | The World Federation of Exchanges (world-exchanges.org)

Established in 1969, Fidelity International offers world class investment solutions and retirement expertise. As a privately owned, independent company, investment is our only business. We are driven by the needs of our clients, not by shareholders. Our vision is to deliver innovative client solutions for a better financial future.

Prior to making an investment decision, retail investors should seek advice from their financial adviser. This document is intended as general information only.

More About

- General

- ETFs

- Individual Stocks

- Managed Funds

- Stocks

- Expert Articles

- Australia

- Fidelity

- Diversification & Asset Allocation