This article has been written by an expert contributor, Kerry Craig, Global Market Strategist, J.P. Morgan Asset Management. Links in the article have been added by Equity Mates Media.

The near-term risk surrounding the real estate market, and in particular the office sector, are less acute than first thought for regional banks.

In brief

- Regional bank stocks have rallied since their May lows as the perceived deposit risk has faded.

- The outsized exposure to commercial real estate (CRE) is a notable hazard but the risk is less acute in the short term.

- The outlook for CRE varies greatly by sector, location and age of asset. The office sector faces the greatest headwinds.

- The potential for further tightening in lending remains a risk to the economic outlook adding weight to a U.S. recession base case.

The mini-crisis in U.S. regional banks has faded as we enter the second half of the year. The risk to deposit flight was addressed early on by the facilities provided by the Fed, Federal Deposit Insurance Corporation and Treasury. Market focus quickly turned to elevated exposure to CRE, the impact of higher rates, an office sector already under pressure from remote working, and what this may mean for banks’ balance sheets.

Recently, investor appetite has returned and the KBW regional bank index has gained 14% since its low in late April. This reassessment of risk appears to be around timing as the near-term risks look less acute. However, there may still be a long fuse from the impact that the CRE has on the banking sector and lending in the economy.

Outlook for CRE varies greatly by sector

The outlook for the private real estate market in the U.S. is mixed. At the headline level capitalization (cap) rate spreads have fallen as operating income growth declines and bond yields rise (click here to read latest Guide to Alternatives). This suggests a lower risk premium and lower expected returns.

Below the headline, the story varies greatly across sector and location. Vacancy rates for offices remain elevated compared to history and other sectors. The headwinds from the pandemic as the adoption of hybrid work patterns or fully remote working are impacting demand for office space.

Even within the office sector the picture diverges. The demand for offices in central city locations remains higher than for areas slightly further afield. Meanwhile, the demands from employers for newer and higher quality buildings that fulfil a changing workplace and ‘greener’ aspirations means absorption rates are higher for newer buildings.

Meanwhile at the other extreme, vacancy rates for industrial real estate continue to plumb new lows. In between, there is retail and residential. Vacancy rates in retail have been declining for the past few months, but the continual squeeze on household spending and risk of recession pose risks to this continuing.

Residential markets may fare better. Years of under investment and the low stock of housing inventory are limiting the downside house prices in certain locations. However, the increase in building in multi-family housing may limit the rise in rents as more supply becomes available.

A slow burning fuse

The outsized share of lending for CRE by regional banks in the U.S. is well documented and lies at the heart of investors concerns. Of the USD3.6tn in outstanding CRE loans in the U.S., USD1.6tn are held by banks with less than USD100bn in assets.

A weaker economic outlook that leads to a repricing of real estate assets, the elevated borrowing costs and the change in demand for office space are headwinds for the sector and could weigh on bank profits or exacerbate the tightening of credit conditions.

The more recent pick up in the performance of regional bank stocks may illustrate the timing of the risk and flexibility in lending. Lenders may be able to extend loan maturity, offer short-term forbearance or even modify loans to avoid foreclosures and losses.

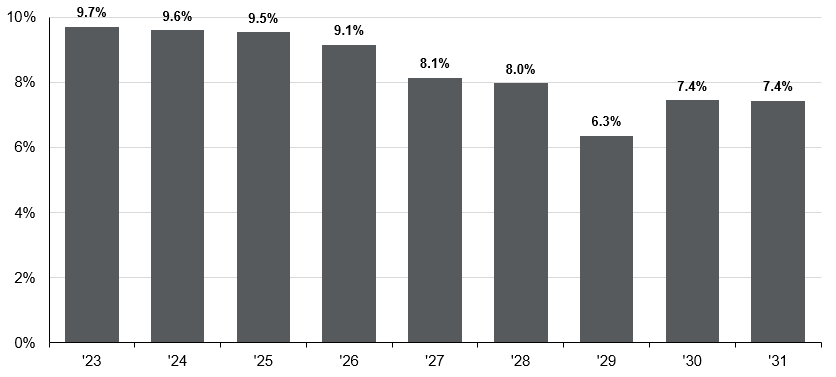

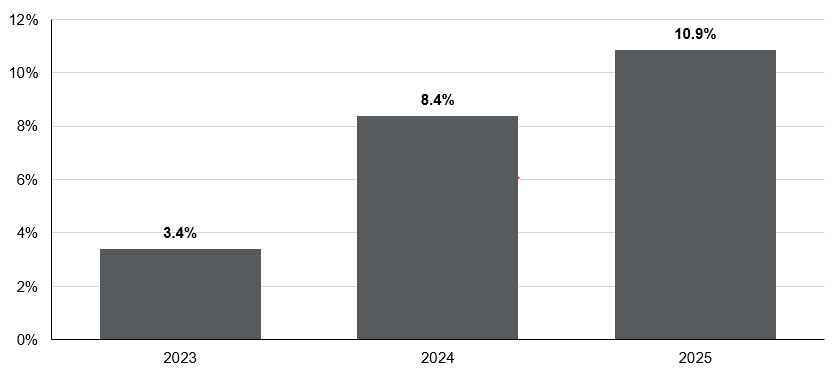

The reassessment of the timing is illustrated by both lease expirations and debt maturity profiles (Exhibits 1 and 2). The path for lease expiration in office space is consistent in the coming years between 9-10%, while the maturity of real estate debt rises slowly in the coming years suggesting there is no cliff in loans coming due. It is also likely that rates will be much lower than today when that refinancing is required.

Exhibit 1: Office real estate lease expiration

Expiration by year at % of total square feet

Source: FactSet, U.S. Bureau of Labor Statistics, J.P. Morgan Asset Management.

Exhibit 2: Office real estate debt maturity

%, of current total debt balance

Source: FactSet, U.S. Bureau of Labor Statistics, J.P. Morgan Asset Management.

Investment implications

So far, lending conditions have tightened sharply to levels not seen outside of a recession. In addition, the long and variable lags of tighter monetary policy are still working their way through into the real economy in the U.S, which poses another clear downside risk to the economy. However, the near-term risk surrounding the real estate market, and in particular the office sector, are less acute than first thought for regional banks.

The challenge to the region banks and broader implications for lending in the economy remain. Any impairment on lending from CRE that restricts other types of lending and slows credit will have a negative impact on growth adding to the risk around a recession or even in the economic recovery following.

The location and age of the office is key in determining the quality of the asset. Beyond the office sector there are still opportunities in private real estate and industrials remains a preferred sector.

Kerry is responsible for communicating the latest market and economic views from J.P. Morgan Asset Management’s Global Market Insights Strategy Team. With more than 10 years’ experience, Kerry provides valuable insights and perspectives on the economy and markets to investors. As a frequent commentator on Bloomberg, CNBC, the AFR and the wider financial press, Kerry is able to explain complex economic and market issues in a language that investors understand.