At Equity Mates Media, we’ve got two podcasts designed to help new investors and those who are yet to get started. Here’s what we’re chatting about this week…

Top 5 thoughts from self-made millionaire Tori Dunlap…

On Get Started Investing this week we are joined by Tori Dunlap, the founder, feminist and financial whiz behind ‘Her First 100K.’ She’s generous in sharing her wisdom, experience building a business, and gave us insights that can help us all on our paths to financial confidence and independence.

Here’s 5 lessons we learned from Tori, including how she invests:

- Leverage high-yield savings accounts:Tori suggests using high-yield savings accounts to maximise the interest earned on your savings. With just a few clicks, you could turn idle cash into a more productive asset. One smart move can help you accumulate wealth faster and secure better returns. We did your homework for you here.

- Get over your ‘analysis paralysis’:Fear of making a mistake can often hold us back from taking action. Tori urges us to avoid getting bogged down by endless analysis and instead focus on taking the first step. Your ‘perfect’ bank account is the one that meets your needs and requires minimum effort to open.

- Embrace those financial chats:Tori argues that one of the most powerful things we can do to bridge wealth gaps is to talk openly about money. By breaking the silence, we can address financial anxiety and inequality, and empower ourselves and others to make more informed decisions.

- Achieving financial security brings you freedom:

The ambitious goal to save 100K by age 25 wasn’t just about the sum. Rather, it served as a “permission slip” for her to take calculated risks, including leaving her corporate job to pursue her entrepreneurial dreams. By having a robust financial safety net, she could explore opportunities with greater security and flexibility. Setting a goal, earning, and saving isn’t about accumulating wealth, but about having the ability to choose the life you want. - Indexes are the way:

Tori is a self described ‘index girlie’ all the way. She believes that investing doesn’t need to be sexy, it needs to be consistent, stable and over a long period of time. She chooses an index fund that prioritises diversification, avoids active management, and chooses something with the lowest fees available.

Tori’s insights remind us that financial confidence and independence are achievable goals when we commit to learning, make smart decisions, and foster open conversations about money.

Passion, or understanding…

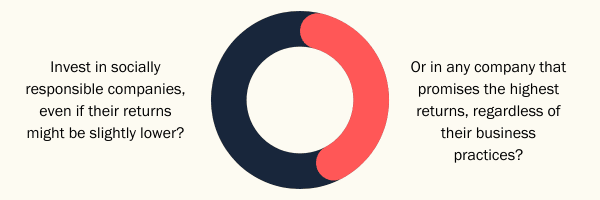

We’ve been wondering about you recently, and what course of action you’d take in certain scenarios. Remember, these questions are hypothetical, anonymous, and there’s infinite options when it comes to investing – not just a or b. This is just for our own fun.

Are you more likely to…

- Invest in a sector you’re passionate about but know little of?

- Or put money in a sector you understand well but aren’t as enthusiastic about?

Curious about last week?

53.85% of you said you’d for for ESG every time, regardless of returns.

What is a good amount to save?

Knowing how much to save is important but how regularly you save is equally so…

We were pondering this very question this week, when we came across this article on Equity Mates that Robin Bowerman from Vanguard. Because if you search ‘how much should I save’ on Google, you’ll get all sorts of guidelines around how much of your income you can spend and how much you should save. Mainly articles focus on a percentage rule – suggesting you should break down your salary or income into 50/30/20 divisions, where 50% goes towards essential living expenses such as rent and utility bills, 30% towards your everyday expenses such as entertainment, eating out and clothing, and then allocating the remainder 20% to your savings.

It’s a recipe for feeling guilty. We never save enough! But actually Robin argues it’s actually just as vital that you regularly save, than getting a huge amount to initially put away. Why? It all comes down to the power of compound interest.

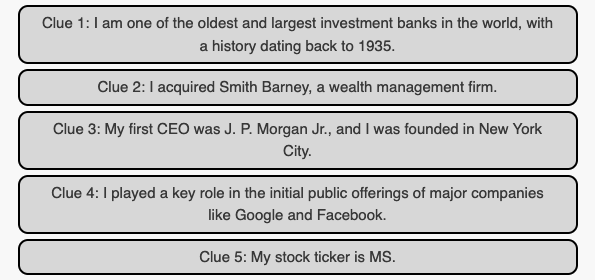

Biznerdle: How many clues do you need?

If you’re craving for a daily brain workout, don’t forget to take a swing at Biznerdle each day. The challenge is simple: Identify a publicly-listed company from a set of clues, with as few hints as possible.

Let’s take a peek at yesterday’s clues… How many did you need to guess right?

How many clues do you need?

Click below to have a go at today’s game.

This is an excerpt from our Get Started Investing Newsletter email. Once a week, for those , we’re featuring some of the most interesting content we’ve come across in this weekly email. No spam, we guarantee.