New year, same investing strategy

What should I be investing in this year?

Every year, the new year brings a flurry of articles suggesting the top investing themes and stocks for the year ahead. People have a tendancy to gravitate towards new ideas and new themes, and the financial media is all too happy to serve it up. We’re here to tell you, most of them can be ignored.

Your best idea is probably already in your portfolio

There is an old adage in investing that ‘your best idea is already in your portfolio’. What it is trying to remind us, is that rather than searching for a new idea, we’d probably be better served doubling-down on an investment we know and are confident in.

This is especially true if you are an ETF investor. The power of investing in broad-based market indexes (those ETFs that hold a little bit of everything like the ASX 200 or S&P 500) is consistently investing in the same assets year after year and letting compounding do its thing.

So, what are you investing in this year?

That is the question we set out to answer in today’s episode of Get Started Investing. Simply, our answer is more of the same.

- Bryce is planning to invest in 4x ETFs that make up his core portfolio – covering Australia, the United States, Europe and Asia

- Ren in planning to invest in 5x ETFs that similarly cover the majority of the world – Australia, the United States, Europe, the United Kingdom and Asia

Listen to the episode wherever you listen to podcasts and find out where we’re investing in 2024.

The power of starting early

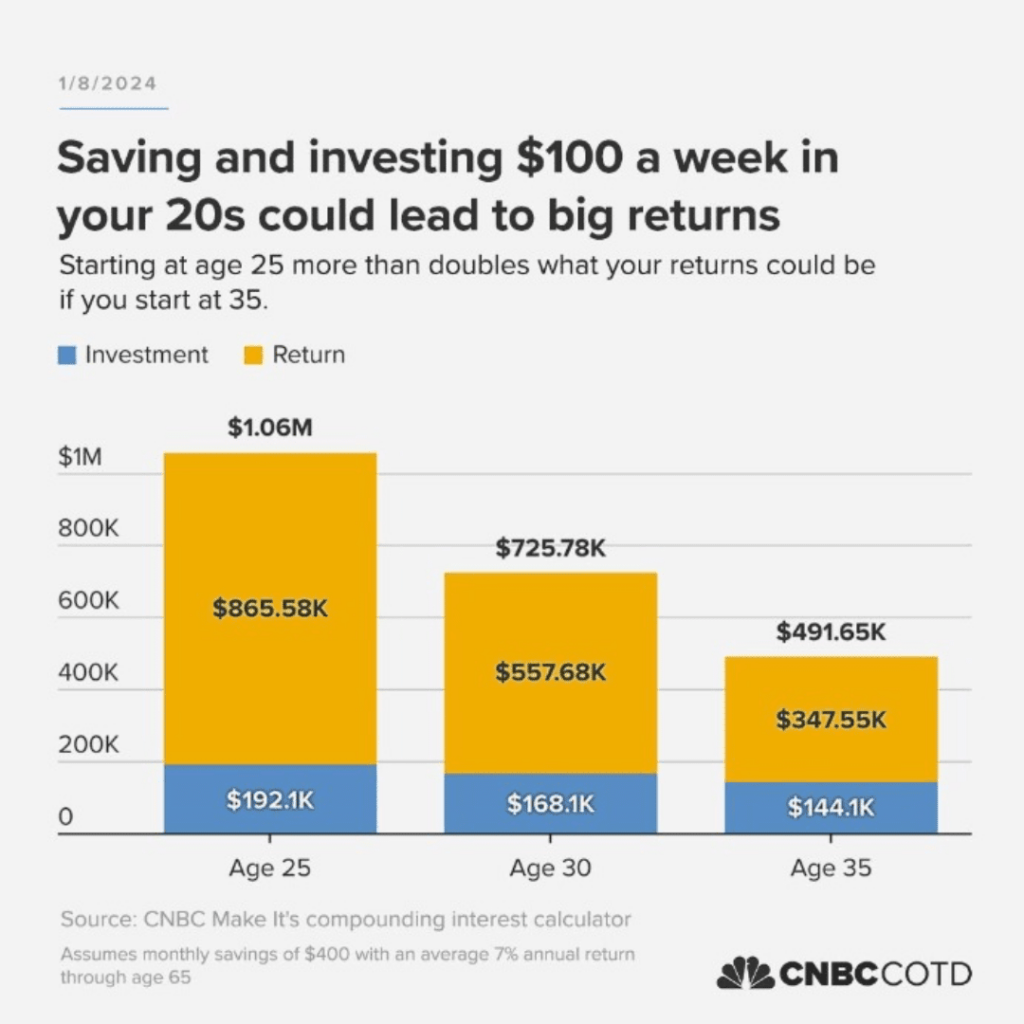

We came across this table from CNBC that is a great summary of why it is so important to start investing early.

In all 3 columns, the person has invested $100 a week until they retired at 65.

- Starting at 25, over 40 years the person invested $192k

- Starting at 30, over 35 years the person invested $168k

- Starting at 35, over 30 years the person invested $144k

That is a $50k difference between the person that started at 25 and 35. However, by the time they retire at age 65 that difference is worth more than half a million dollars!

How, you might ask. That is the power of compounding. Earning a consistent rate of return (in this example 7%) year, after year, after year makes a big difference.

So if you’ve put off getting started, let this be your reminder of the power of starting early.

As always, if you’ve got a question, let us know at ask@equitymates.com.

Until next week, happy investing!

This is an excerpt from our Get Started Investing Newsletter email. Once a week, for those , we’re featuring some of the most interesting content we’ve come across in this weekly email. No spam, we guarantee.