At Equity Mates Media, we’ve got two podcasts designed to help new investors and those who are yet to get started. Here’s what we’re chatting about this week…

Why you should (and shouldn’t) autopilot your investing…

Ever thought… “Why don’t I just invest in an S&P 500 index fund and be done with it?”

James recently had the same question, and it got us thinking. Today, on Get Started Investing, we put our heads together and found 2 compelling reasons to do it, and 1 reason why you may want to re-think that idea…

But before we do – you need to understand automated investing. It’s a bit like setting a regular alarm for your investments. You set up a rule with your broker, telling it to put in a consistent amount of money at regular intervals. Usually, this goes into a well-diversified index fund, like an S&P 500 index fund or ASX 200, or a global fund like Vanguard VDHG or Betashares DHHF.

On Get Started Investing this week we are joined by Tori Dunlap, the founder, feminist and financial whiz behind ‘Her First 100K.’ She’s generous in sharing her wisdom, experience building a business, and gave us insights that can help us all on our paths to financial confidence and independence.

So, what are our reasons for and against?

#1: The Power of Dollar-Cost Averaging

This strategy is like your very own investing superpower. Dollar-cost averaging lets you buy more when the stock market is cheap and less when it’s expensive. The result? Your price averages out over time. Sure, no one can pinpoint the market’s lows and highs, but that’s not a reason to lose sleep.

#2: Companies Die, Indexes are Forever

Here’s a startling stat from Geoffrey West’s book, Scale: out of 28,853 companies listed on the US stock market since 1950, 78% had gone bankrupt by 2009. It’s a sobering reminder of how tough the corporate world can be.

However, despite this, the US stock market has grown a staggering 23,249% since 1950. Ummm what? Take IBM, General Electric (GE), and Apple. These household names highlight why investing in individual companies can be risky. Each were the biggest American company in 1980, 2000, and 2020, but respectively, they’ve each had different fates. If you’d put $1,000 into GE in 2000, you’d be left with just $200 today. But if you’d invested that same $1,000 in the S&P 500? You’d be looking at a healthy $2,700 now.

However, before you run off to your broker and get all excited to set up automated investing – have a think about the reason you wouldn’t:

#3: Countries Rarely Go Back-to-Back

It’s really more a reason to consider diversification: countries rarely have the best performing stock market two decades in a row. The UK had the highest returns in 1900, but the US took over in 1910 and kept the lead in 1920.

In essence, automated investing is a savvy way to leverage the benefits of dollar-cost averaging, capitalise on the longevity of indexes over individual companies, and take advantage of global market trends. It’s worth a serious look for anyone keen on growing their wealth over the long term, but as always, make sure you do your own research.

Happy investing!

We’re curious about you…

What would you choose in this scenario? Remember, these questions are hypothetical, anonymous, and there’s infinite options when it comes to investing – not just a or b. This is just for our own fun.

Would you choose….

- A traditional savings account with a fixed interest rate…

- Or a peer-to-peer lending platform with higher returns but higher risk?

Curious about last week?

72% of you said you’d go for boring but understandable over enthusiastic, but limited knowledge…

How do you choose a broker?

Whenever you decide to start investing – a huge congratulations is in order. But then you might get nervous… because before you start buying shares of your favourite companies, you’ve got to take that crucial first step: choosing a broker.

Here’s our list of things to check over:

- Cost: Check what you’re handing over! Brokers may charge fees for their services, which can eat into your investment returns. Some may offer commission-free trades, but make sure to check for other fees, like account maintenance or inactivity fees.

- Access. Some brokers allow you to trade on overseas markets, opening up a world of investment opportunities. If you’re interested in investing in companies outside of Australia, this is a factor to consider.

- Bells and whistles: This is our term, not the technical one. It’s a question of market data. Brokers often provide access to real-time or delayed market data. This information can be crucial in making timely investment decisions.

- Community: Many brokerage platforms are fostering communities where investors can learn from each other, share ideas, and get insights. This can be a valuable resource, especially for new investors. (The best is still Equity Mates, we know you know that).

You’ve probably got heaps more questions – so check out our episode on Choosing the Right Broker for You. We discuss the factors to consider and share our personal experiences with choosing our first brokers.

Choosing a broker is the first decision every investor makes, and it’s an important one. But with the right information and resources, you can find a broker that fits your needs and helps you on your investing journey.

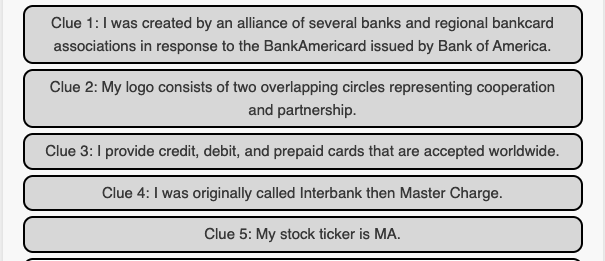

Biznerdle: How many clues do you need?

The challenge is simple: Identify a publicly-listed company from a set of clues, with as few hints as possible.

Let’s take a peek at yesterday’s clues… How many did you need to guess right?

How many clues do you need?

Click below to have a go at today’s game.

This is an excerpt from our Get Started Investing Newsletter email. Once a week, for those , we’re featuring some of the most interesting content we’ve come across in this weekly email. No spam, we guarantee.