This article has been written by expert contributor, Tony Kaye, Senior Personal Finance Writer, Vanguard Australia.

There’s a lot of variables when it comes to investing but one thing is for certain: the less you pay in investment fees, the more returns you get to keep.

When it comes to investing, no one can accurately predict future returns.

After all, investment markets move up and down on a daily basis for a wide range of reasons.

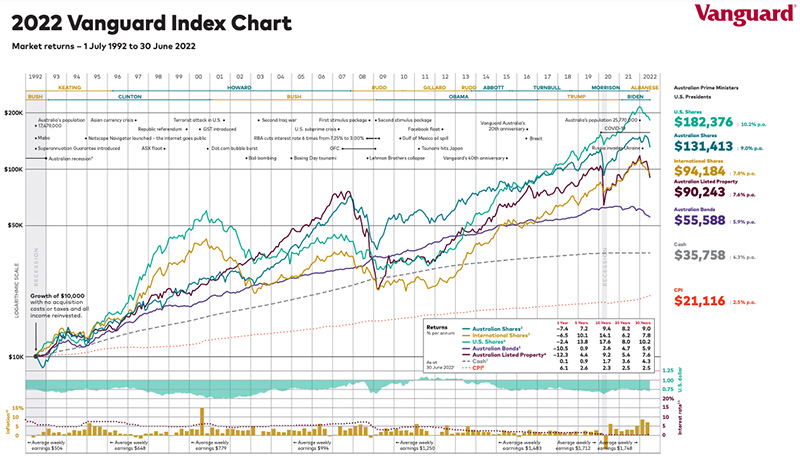

As the 2022 Vanguard Index Chart demonstrates, you can reasonably expect that your initial investment balance will increase incrementally over time based on average annual returns and compounding growth.

Your longer-term returns are likely to be even higher if you keep adding to your initial investment balance on a regular basis.

But one thing that can be guaranteed with investing is that there are generally costs involved.

These can involve investment management fees on exchange traded funds and managed funds, and one-off transaction fees such as stock brokerage when you invest in listed securities.

Investment costs can make a significant difference to your long-term returns. And the lower your overall costs, the more money you get to keep.

Vanguard founder John C. Bogle summed costs up this way:

“In investing, you get what you don’t pay for. Costs matter.”

While you can’t control what happens on investment markets, you can definitely control what you choose to pay in investment costs.

Calculating the impact of fees

Understanding the long-term impact of fees on your investment return is important.

The calculations below have been made using the moneysmart.gov.au managed funds fee calculator.

You can use it to do your own calculations, based on your investment amount, time frame, and by entering in projected investment earnings, fund fees and costs information.

Our examples are based on an initial investment amount of $10,000 being held for 10 years, and an average annual return of 9.4 per cent.

This return equates to the performance of the Australian share market over the 10-year period from 30 June 2012 to 30 June 2022.

The example below assumes no additional investment contributions were made over time and for comparison uses three sample annual management expense ratios (MERs) of 0.10 per cent, 0.25 per cent, and 0.50 per cent.

The MER is the standard fee charged by fund managers when you invest in ETFs or managed funds.

| Initial investment amount | Management Expense Ratio | Balance after 10 years | Effect of fees after 10 years* |

| $10,000 | 0.10% | $24,314 | $243 |

| $10,000 | 0.25% | $23,955 | $602 |

| $10,000 | 0.50% | $23,368 | $1,189 |

* Based on a 9.4 per cent annual return. Excludes brokerage fees. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance.

The effect of fees on the end balance after 10 years is clear, rising from just $243 at the lower end to almost $1,200 at the higher end.

Of course, fees are substantially higher on larger investment amounts and over longer investment periods.

What are the fee impacts from making extra investment contributions over time?

Using the same criteria as above, here’s how the fee numbers would stack up over 10 years based on regular $200 fortnightly contributions ($20,800 per year).

| Initial investment amount | Management Expense Ratio | Balance after 10 years | Effect of fees after 10 years* |

| $10,000 | 0.10% | $107,782 | $716 |

| $10,000 | 0.25% | $106,719 | $1,778 |

| $10,000 | 0.50% | $104,976 | $3,522 |

* Based on a 9.4 per cent annual return. Excludes brokerage fees. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance.

Again, the variation in fees based on different MERs over just 10 years are significant.

Factoring in brokerage fees

Brokerage fees on buy and sell transactions involving listed market securities, such as shares and exchange traded funds, add another element to the costs equation.

Stockbrokers typically charge brokerage to execute a transaction.

The example below compares the impacts of ongoing management fees and regular brokerage fees over 10 years based on an initial investment of $10,000, regular $200 fortnightly contributions, and a $9 brokerage fee per transaction (26 transactions per year).

| Initial investment amount | Management Expense Ratio | $0 brokerageBalance after 10 years | $9 brokerage per fortnightBalance after 10 years | Effect of fees after 10 years |

| $10,000 | 0.10% | $107,782 | $104,177 | $4,321 |

| $10,000 | 0.25% | $106,719 | $103,142 | $5,355 |

| $10,000 | 0.50% | $104,976 | $101,455 | $7,053 |

* Based on a 9.4 per cent annual return. Excludes brokerage fees. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance.

The addition of a $9 brokerage fee per buy transaction would add more than $3,500 to total fees over 10 years.

As part of Vanguard’s ongoing commitment to lower investment costs and make it easier to invest, we’ve removed the $9 brokerage fee for buying Vanguard ETFs through the Vanguard Personal Investor platform. The $9 brokerage fee for selling Vanguard ETFs remains.

Minimise your costs

The bottom line is that, in addition to focusing on investment returns, you also need to focus on investment fees.

Returns are not consistent, but fees are. You’ll pay them, even when investment returns turn negative.

While a few percentage points may not sound a lot, they will add up to thousands of extra dollars in fees on larger investment amounts and over longer periods of time.

Tony Kaye is Senior Personal Finance Writer at Vanguard Australia. In his role, Tony regularly produces topical investment-related articles and educational content designed to help investors make well-informed decisions. Tony is a former managing editor and financial journalist, and his articles are published in Vanguard’s weekly Smart Investing newsletter and elsewhere. The above material has been republished with the permission of Vanguard Investments Australia Ltd.

Learn more about Vanguard here.

Prior to making an investment decision, retail investors should seek advice from their financial adviser. This document is intended as general information only.