This article has been written by expert contributor, Tony Kaye, Senior Personal Finance Writer, Vanguard Australia.

The power of diversification. Why moving to cash in a panic rarely pays off.

It’s understandable that heightened share market volatility can be unsettling.

Yet, making emotional investment decisions in response to day-to-day movements on markets may have negative long-term consequences.

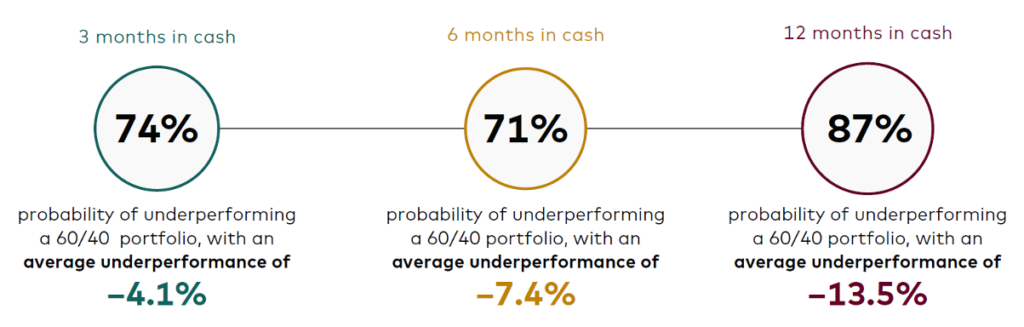

For example, as the illustration below shows, investors who overreacted to market events by moving to cash have generally underperformed over time against diversified portfolios with a 60% investment weighting in equities (shares and property securities) and 40% in fixed income (bonds). Long periods out of the market can make matters worse.

Return distribution of moving to 100% cash

Notes: Equities in the 60% equity/40% fixed income portfolio are represented by the Russell 3000 Index, and fixed income is represented by the Bloomberg U.S. Aggregate Bond Index. Cash is represented by the FTSE 3-Month Treasury Bill Index. Monthly data are from January 1980 through December 2022. Equity losses of more than 10% over three months trigger the move from a 60/40 portfolio to all cash in the illustration. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Source: Vanguard total return calculations, as of 31 December, 2022.

The keys to smoother investment returns

It’s well known that spreading your money across different assets helps to offset market volatility and deliver smoother returns over the long term.

The reason is simple. Different assets perform differently from year to year. The best-performer one year can be the worst the next. Diversifying your investments means you’re not exposed to just one asset type.

While you can’t control what the markets do every day, there are things you can manage, such as what you invest in, how much you invest and pay in costs, and how long you stay invested.

Vanguard’s core principles of setting achievable goals, diversifying across asset classes, minimising investment costs, and remaining disciplined are at the heart of our investing philosophy.

They’re also the pillars for Vanguard’s low-cost range of diversified exchange traded funds (ETFs) and managed funds, which provide access to a pre-set mix of different asset classes and sectors within a single fund.

Think of them as ready-made investment portfolios. Rather than trying to build your own, they’re already built. You can choose from our range of diversified funds, which is designed to deliver returns over the long term based on the level of risk that you’re willing to take on. That will largely depend on your investment goals and your time horizon.

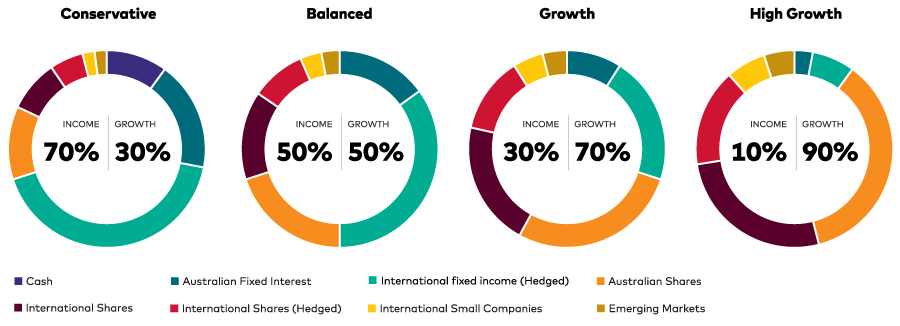

The percentage allocations to growth securities (shares and property securities) and fixed income securities are the main factors influencing the risk/return profiles of our diversified fund portfolios. You can see the respective asset allocations of the funds in the illustration below.

Vanguard diversified funds

Source: Vanguard

How can I use diversified funds in my portfolio?

Depending on your investment plan and the level of control you desire, you can use a diversified fund as the core of your portfolio and then add other smaller investments to round out your strategy. Whichever strategy you choose, it’s important to focus on the fundamentals of having a well-diversified portfolio so your money is invested in a range of different assets.

Tony Kaye is Senior Personal Finance Writer at Vanguard Australia. In his role, Tony regularly produces topical investment-related articles and educational content designed to help investors make well-informed decisions.

Tony is a former managing editor and financial journalist, and his articles are published in Vanguard’s weekly Smart Investing newsletter and elsewhere.

The above material has been republished with the permission of Vanguard Investments Australia Ltd.