This article has been written on 20th of October, by an expert contributor Layton Membrey from Marcus Today

Key Points

- Record production of 51.2MMboe, up 52% QoQ

- Record sales volume of 57.1MMBoe, up 59% QoQ

- Record revenue of $5.858bn, up 70% QoQ

Woodside Energy (WDS) released its third quarter report this morning with some solid-looking numbers at first glance. WDS delivered record production of 51.2 MMboe for the quarter, up 52% from the second quarter.

This was accompanied by record sales volume of 57.1MMboe – a 59% increase on the previous quarter. And revenue of $5.858bn, up 70% from the second quarter on an average realised price of $102/barrel.

To cap off the results, the group upgraded full-year production guidance to between 153-157 MMboe, with the previous range between 145 – 153MMboe. Within the guidance update, the group also increased the exploration expenditure range to between $500m and $600m but lowered total capital expenditure to between $4.0bn and $4.3bn.

This production and revenue increase comes as a result of the first quarter of full operation from the former BHP Petroleum business. CEO Meg O’Neill said, “This is our first full quarter following the merger, and these results demonstrate the new, expanded Woodside is delivering what we promised: safe, reliable energy from a more diverse portfolio.”

The group is also working on expansion into “new energy” and has placed an order for an alkaline hydrogen electrolyser for its first hydrogen project – H20K. WDS has signed a joint agreement to undertake a feasibility study in the development of an ammonia supply chain from Australia to Japan.

The Energy Sector

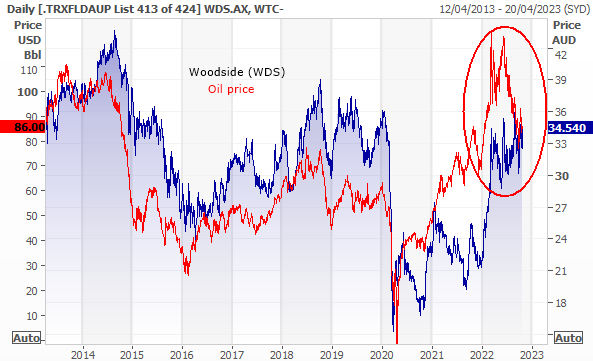

The oil price fell steadily throughout the third quarter as the Ukraine War-inspired rally in all energy prices matured and peaked. Biden has been tapping into oil reserves in an attempt to stabilise the price, and OPEC+ agreed to increase production – even if it was just 100k barrels per day.

The chart above shows an interesting disconnect in the traditional correlation between Woodside and the oil price trend. The oil price has peaked but WDS has continued to rise.

Fundamentals

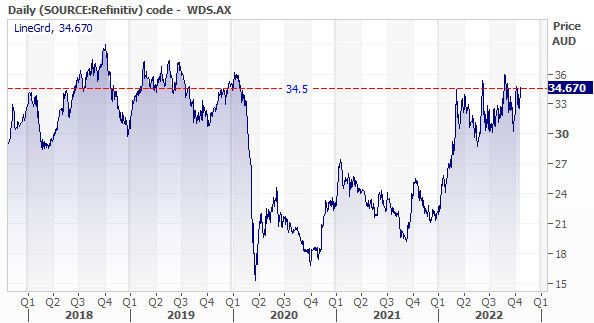

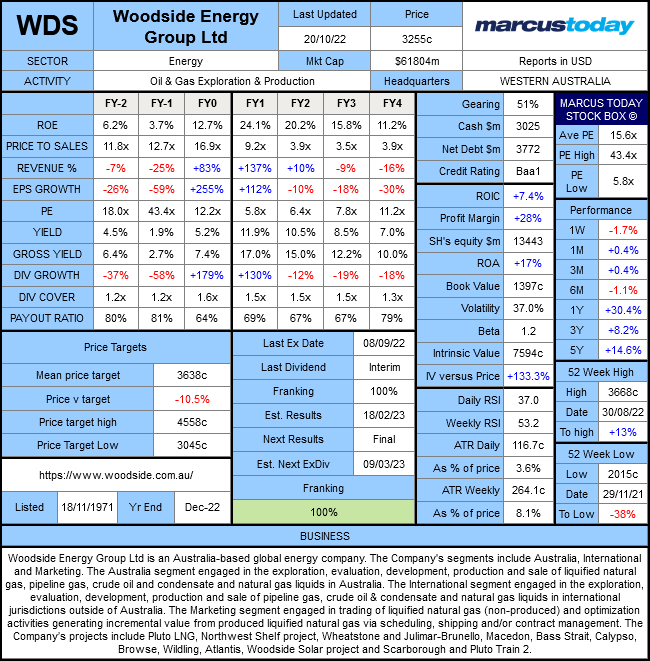

Woodside Energy (WDS) had a stellar year, with EPS growth of 255%, far exceeding revenue growth of 83%. Both revenue and EPS are expected to grow considerably this year, and dividend growth of 130% leads to a gross yield of 17.0%. The share price has found itself back at pre-pandemic levels for most of this year. It is now looking to be top of its recent trading range of $30-36.

Our Take

We’ve been looking for an event that will signal the collapse of the energy sector, it is a balance between the war narrative and the European energy crisis and the fear of global recession and the impact that will have on the demand for oil.

We commented recently that the energy trade might be coming to a halt, but this bumper result from WDS has put it back in the box seat for investors. We’ll see what the broker’s reaction is tomorrow, but it is likely to include recommendation and target price upgrades. The yield is fine, but there’s no dividend until February after the final results (December year-end).

The share price has jumped 6.5% today on the update. Income investors will be sure to collect what is expected to be another massive final dividend from the group, but there’s no need to rush into it. Investors looking for capital growth should be wary of this stock, so much of its performance is tied directly to commodity prices, the remainder of the year is somewhat de-risked, but a sudden change in the macro environment could spell disaster for energy stocks. T

There is an understanding among professional fund managers that in Australia, counterintuitively, you buy resources when the PEs are 60x and the yields are 0.6%, and you sell them when the PEs are 6x and the yields are 16%. Numbers below. The PE is 5.8x and the yield 17%. I’d let this positive vibe wash over the stock for a few days but would not cling to WDS (or other energy stocks) once the sector cracks. Which it has already. No rush, but this result could be the icing on the cake. WDS is not an income stock, it is a trading stock with a yield.

Marcus Today Stock Box – Thursday, 20 Oct 2022

More about the author – Layton Membrey

Layton Membrey has been working with the Marcus Today Stock Market Newsletter since 2021. He is currently undertaking a Master of Commerce specialising in Finance at Deakin University, which he will complete in 2023. Under the guidance and expertise of Marcus and Henry, he has been able to develop an investment style that reflects a combination of their technical and fundamental values.

You can sign up for a free trial here.

First published on 20th October 2022 on the Marcus Today website.