This article has been written on 18th of November, by an expert contributor Marcus Padley from Marcus Today

Elders (ELD) plummeted on the release of results on November 14 (Monday). Down 22.9% on the day of the release. Henry bought it as a trade feeling the sell-off was overdone in the short term.

Some bullet points:

- Announced the retirement of their long-time CEO next year, who has been a mainstay for the company for over a decade.

- Sales increased 35% to $3.4bn.

- Underlying EBIT increased 23% to $232.1m missing brokers’ forecasts causing the stock price to drop.

- Outlook remained positive with favourable trading conditions expected to continue with high demand in the first half of FY23.

- Short term the recent extreme rainfall across the eastern states has created uncertainty in the affected regions and may not yield a full harvest.

- Strong demand in chemicals and fertiliser is expected to continue.

- Cattle and Sheep prices are expected to soften in the medium term.

- Wool demand remains strong from China and other Asian nations.

- Elders Board Chair has commented that “Australian agriculture is in a strong position. Good seasonal conditions, strong commodity prices, and record demand for Australian agricultural products are all contributing to a very favourable production environment and a sense of confidence and excitement for the years ahead”.

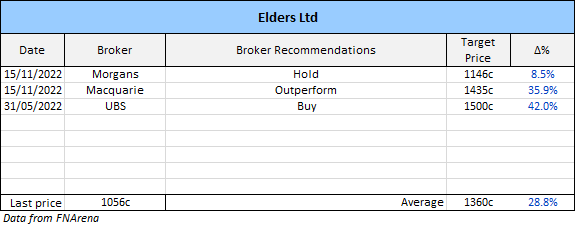

BROKER VIEWS

Not a lot of broker coverage.

Morgan’s note cash flow was well below expectations, it will be hard to meet 2023 earnings growth after such a strong 2022, and the CEO resignation overshadowed the results announcement. Its been a bumper past which they now expect to ‘normalise’. Macquarie is more optimistic thinking they can match the 2022 growth with a combination of organic and acquisitive growth saying strong agricultural conditions continue into this year. The full-year numbers beat their expectations up 39%. They forecast $218m this year down from $232m.

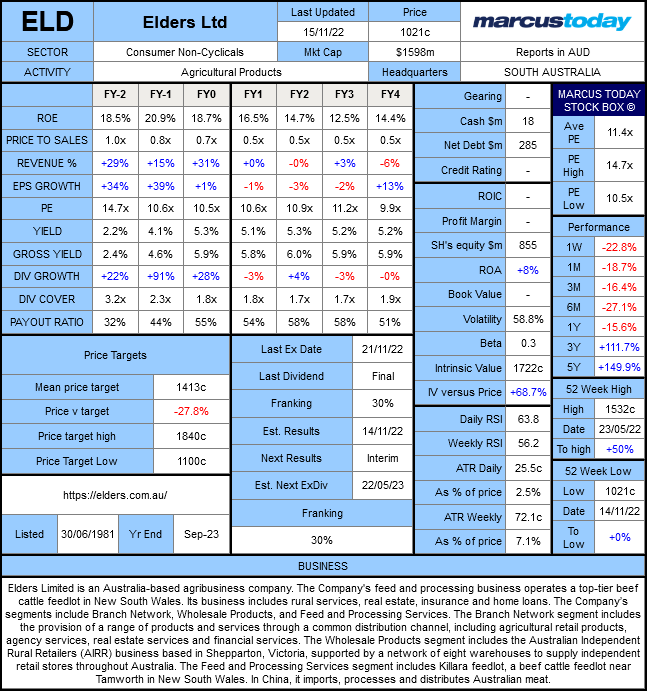

THE NUMBERS

Elders has strong financials; earnings show positive growth year on year this year but the story is in the numbers – growth reverrts to zero after a very strong year. Rural stocks like ELD are highly seasonal. Whilst they have celebrated a great year, it never lasts ‘in the country’ in Australia. Dividend growth was strong, and ROE averages approximately 17%. Elders is a strong-value stock with a current PE of 10.6x. The departure of the CEO has clearly shaken the market, but they have given themselves plenty of time to find a suitable replacement, and it is very doubtful that anything will actually change internally.

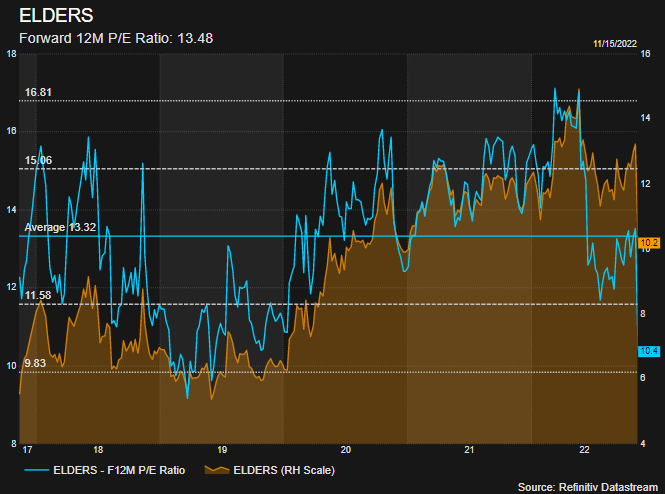

PE HISTORY

The Forward PE history is in blue. The 5 year average is 13.3x. It has just dropped to 10.4x. Looks ‘cheap’. Lowest PE in years.

CHART

The sell-off yesterday was seismic and Henry was right – it is technically oversold in the short term having dropped from the top to the bottom of a well established long term trading range.

Conclusion

ELD had a big rally last year when it became apparent that Country Australia was having a boom year (perfect growing conditions). But these conditions and the stock, as with most agriculture and rural stocks, especially in Australia (Drought ridden), are seasonal with good years and bad years and not much in between. They have reported the boom year, and now the prospect is for a flat year (hard to repeat) and the market is sobering up to that and the exit of the founding CEO at what some obviously perceive as the “Top”. But this year and the next decade will as always, produce boom and lean years. From this PE level, the lowest PE in almost 10 years after the sell-off yesterday, ELD does look fundamentally and technically oversold. Just because it was a boom year last year doesn’t mean it will be a lean year next year. There is a recovery rally to be had, after that this is a stock that you trade as the seasons dictate (good or bad years). I would not hold it for growth, it’s an unreliable stock (by nature…literally because of nature), and you can trade it in its range. But its a small range so it’s not even a great trading stock. Not enough movement. It reflects the wealth of the “Country Australia”. Buy when you see crops everywhere. Sell when farmers are kicking the dust. I wouldn’t bother with it ever except as an occasional trade when I see a farmer in a Range Rover.

More about the author – Marcus Padley

Marcus Padley is a highly-recognised stockbroker and business media personality. He founded Marcus Today Stock Market Newsletter in 1998. The business has built a community of like-minded investors who want to survive and thrive in the stock market. We achieve that through a combination of daily stock market education, ideas and activities. You can sign up for a free trial here.

First published on 18th November 2022 on the Marcus Today website.