This article has been written on 16th of November, by an expert contributor Layton Membrey from Marcus Today

Aristocrat Leisure (ALL) is a high-conviction stock for many investors. We hold it in the Long-Term Growth Portfolio. The group reported FY22 results this morning with strong revenue and profit growth that was a slight miss on estimates. The share price is down 5.5% this morning, as management failed to provide meaningful guidance with any figures and gave us the typical “expects to deliver profit growth over the full year to September 2023”.

Highlights:

- Revenue growth of 17.7%

- Profit of $1.1bn, up 27.1%

- Net cash of $564m

- On-market buy-back of $340m

- US$250m repayment of loans

- Fully franked dividend of 52c, up 26.8%

- Profit growth is expected to continue in FY23, with innovation and investment to drive market share gains

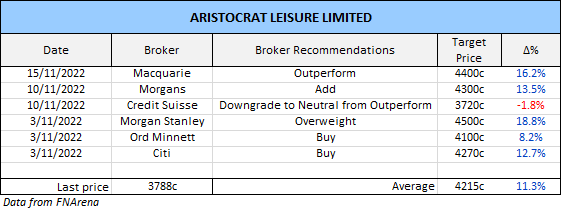

Broker Recommendations

The previous broker research on ALL is fairly positive. Macquarie updated its research yesterday, leading into results this morning. The broker expected profits to lift 30% year-on-year, which includes a $61m foreign exchange benefit. The outperform recommendation and 4400c target price were retained. Macquarie says it has “high conviction” in ALL and sees attractive valuation on a 19x FY23 PE. Four of the other five brokers have buy or outperform iterations, with Credit Suisse, the only broker with a target price below the current share price. But remember these recommendations were all given pre the results today. The average target price is 4215c, implying an 11.3% upside. We will see more tomorrow.

The Numbers

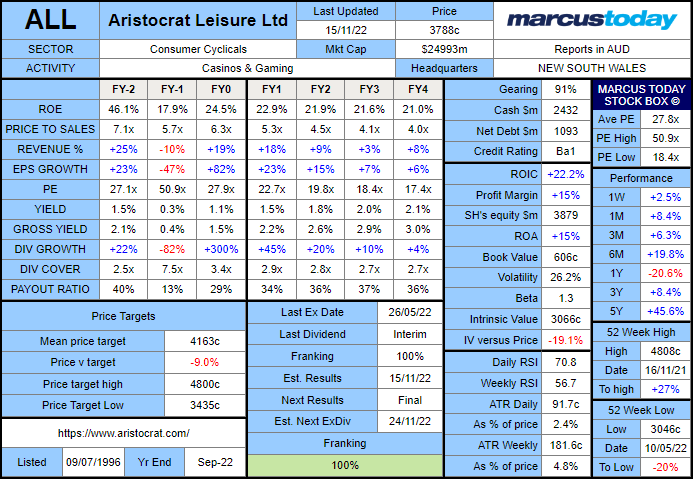

Aristocrat Leisure is a growth stock with an average PE and low yield. It’s trading on a PE of 22.7x, so it’s not exactly cheap, but the PE is expected to fall in each of the coming years. Revenue growth and EPS growth is expected to be positive in the next 4 years, and it’s good to see EPS growth outpacing revenue growth, but both are decreasing over the next four years. Last year saw EPS growth of 82%, while this year, 23% is expected. The current yield is only 1.5% which grosses up to 2.2%. The group has a strong dividend payout history, with a dividend paid every year since 2012, but the 5-year average total yield is only 1.39%.

The Chart

The share price has been in a bit of a sideways trend since June. Looks like there is a bit of a support level around 3200c that it’s bounced off a couple of times in the last 6 months. Should provide some support if the sell-off continues. The stock was also very close to reaching overbought levels, and this sell-off has dropped it back down to normal levels.

Conclusion

Aristocrat Leisure (ALL) is a stock that most growth investors would hold. This morning’s price move looks like a bit of a knee-jerk reaction to a slight miss on growth numbers. US dollar strength hurt the numbers a bit. The group also commented on higher tax payments, increased working capital, and high inventory levels due to supply chain disruptions. But, with double-digit profit and revenue growth, a strong cash position and profit growth expected to continue in FY23, the group had a high bar to meet. The industry is widely thought to be “recession-proof”, with apparently no current change to consumer behaviour, which is promising for growth prospects in FY23. The group holds market-leading positions in the gaming sector and expects this to underpin continued strength in revenue and profit growth. The sell-off looks overdone, and this presents a good opportunity to buy a high-quality growth stock at a discount.

More about the author – Layton Membrey

Layton Membrey has been working with the Marcus Today Stock Market Newsletter since 2021. He is currently undertaking a Master of Commerce specialising in Finance at Deakin University, which he will complete in 2023. Under the guidance and expertise of Marcus and Henry, he has been able to develop an investment style that reflects a combination of their technical and fundamental values.

You can sign up for a free trial here.

First published on 16th November 2022 on the Marcus Today website.