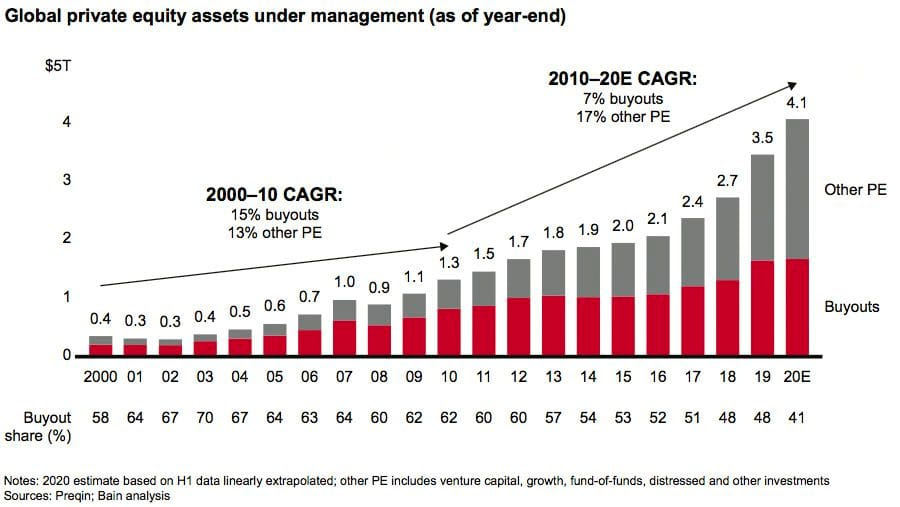

Over the two decades there has been a flood of money moving into private equity.

Private equity companies are then tasked with finding places to deploy this capital. Which has led to a flurry of deal making. Some PE firms have focused on buying large listed companies and taking them private. Last year in Europe, delisting transactions involving private equity firms nearly doubled to $78 billion, up from $40.7 billion in 2021. Other PE firms have targeted earlier stage companies and have moved more into venture capital. According to Pitchbook, in 2021 private equity firms participated in more than half of all US venture capital deals (measured by value), up from just 37% in 2019.

However, there is nothing private equity likes more than a rollup. Acquire a number of independent businesses in the same industry, merge their back office and supply chain operations, improve their margins, use those margins to borrow more, acquire more and grow. Private equity has rolled up everything from dentists to storage units. And the financial returns often are pretty good.

However, a new review of dozens of international studies focused on private equity rollups of healthcare facilities shows the first large-scale evidence that private equity takeovers are associated with rising costs and sinking quality of care.

These findings are American, we should be clear. The experience with private equity isn’t universal and healthcare regulations in Australia and Europe are certainly better than in the United States. And some of the most successful rollups in the healthcare space have been successful because they free medical professionals from the task of running a small business and allow them to focus on patient care (for an example of a company trying to do this, listen to our interview with the CEO of Pacific Smiles, Phil McKenzie – Apple | Spotify | Website).

However, these findings are a sobering reminder of the challenges of increasing private equity ownership. And between nursing homes, fertility clinics, doctors and dentists, there is plenty of attractive opportunity for private equity in the healthcare space. It is a reminder that government policy needs to keep pace with the changing healthcare landscape to ensure well-trained staff and good patient outcomes remain the priority.

This is an excerpt from our Thought Starters email. Once a week we send you 5 interesting articles that have caught our attention, to get you thinking. No spam, we guarantee.