While we don’t have a strong view on crypto here at Equity Mates, we are fascinated to watch the story unfold. Read on for some of the most interesting Tweets, articles and memes from the past week below.

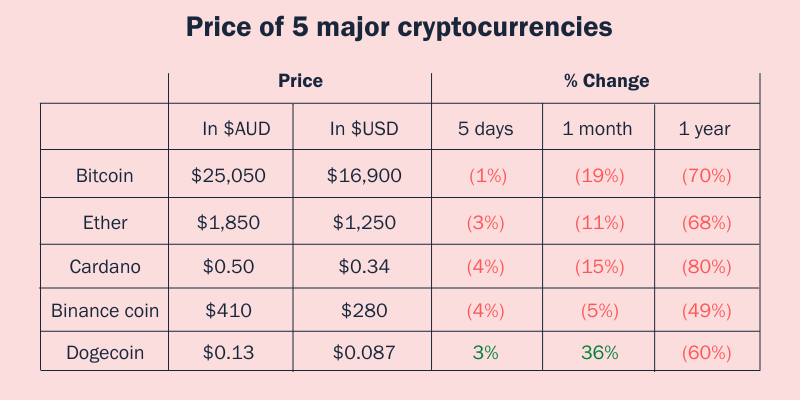

Prices of Top Cryptocurrencies

Tweets & Charts of the week

Articles & Videos

Bankrupt exchange FTX could have more than 1 million creditors and has been in contact with “dozens” of regulators around the world, according to court documents. The numbers underline the far-reaching impact from the stunning collapse of one of the industry’s biggest players.

Opinion: FTX’s spectacular collapse shows crypto will never be the future of money. Dubbed the ‘Lehman Brothers’ moment for crypto, last week the second-largest exchange, FTX, spectacularly imploded as investors realised putting their hard-earned money into an unregulated and highly speculative ‘asset’ probably wasn’t the wisest idea.

Unlike in previous crashes, the president of El Salvador, Nayib Bukele, who made Bitcoin a legal tender a year ago, did not exhort his followers to “buy the dip”. The laser eyes, popular among crypto currency traders, have long since been removed from his Twitter profile. On the day that FTX declared insolvency, he announced that the country would sign a free trade agreement with China. His vice-president, Félix Ulloa, said that China had offered to buy the country’s $21bn in foreign debt as part of the deal.

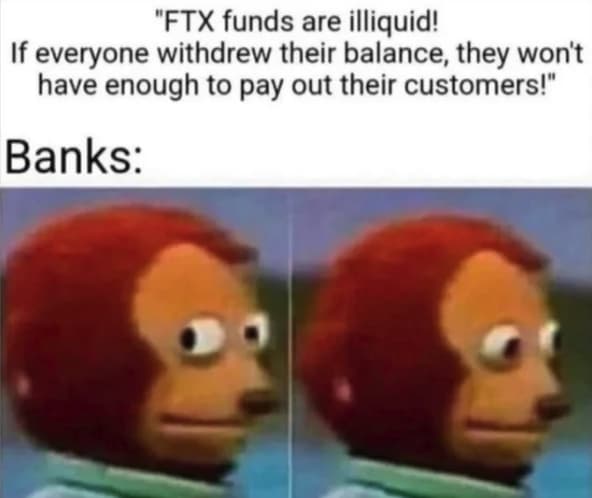

A quick meme break

Back to it

Will the spillover from Sam Bankman-Fried’s FTX collapse be confined to the crypto sphere, or will it rattle global share markets? That is a key question for most investors as allegations swirl that FTX improperly used billions of dollars of customers’ money to prop up a trading firm, Alameda Research, that was also founded by Bankman-Fried.

A new study has found that three out of four investors in Bitcoin have lost money. The study found new retail investors drove the spectacular rise in bitcoin prices between 2015 and 2021.

The inside story of the FTX collapse. Jon Deane remembers his boss at JPMorgan screaming across the commodities trading floor as Lehman Brothers, the US bank, plunged towards bankruptcy in January 2008. Deane has moved on from his commodity trading days and now runs a crypto asset manager and blockchain technology provider, Trovio Group. But the collapse this week of one of the world’s most respected crypto exchanges brought back unwelcome memories of the Lehman failure that sparked the global financial crisis.

As a co-founder of Ethereum, Vitalik Buterin is one of the most prominent voices in crypto. He took to Twitter early Tuesday morning to urge his audience not to write off everything FTX’s departing CEO Sam Bankman-Fried did as a part of “the fraud.”

The AFL is sticking by its Crypto.com partnership amid fears the company could be caught up in a market spiral after the collapse of FTX. The collapse has already had implications for the wider cryptocurrency sector, with the value of Bitcoin declining from US$20,000 to US$16,600 since the news broke.

And another

In Focus: What else… Crypto Curious wrap up the FTX saga

Trace, Blake and Craig record a special episode to take a deep dive into the spectacular demise of Sam Bankman-Fried’s FTX Exchange. Exactly what happened, who was involved and why? They’ll try to answer some of these questions as best as possible in an ever evolving situation.

[Listen to the episode here]

This week Trace and Craig are joined by a special guest and NFT Godfather here in Australia – Greg Oakford. They discuss the recent developments to break regarding Instagram and how they are incorporating digital collectibles (NFTS) onto their platform. They get clarity from Greg around how exactly royalties are calculated for NFTs and what the OpenSea situation has been over the past week. Lastly they discuss the current NFT market outlook and cover off on all the fun things that will take place at NFT Fest Australia over the 23rd & 24th November.

[Listen to the episode here]

Some of our favourite content

This is an excerpt from our Crypto Newsletter email. Once a week, for those investing in crypto or interested in learning more about this corner of the market, we’re featuring some of the most interesting content we’ve come across in this weekly email. No spam, we guarantee.