While we don’t have a strong view on crypto here at Equity Mates, we are fascinated to watch the story unfold. Read on for some of the most interesting Tweets, articles and memes from the past week below.

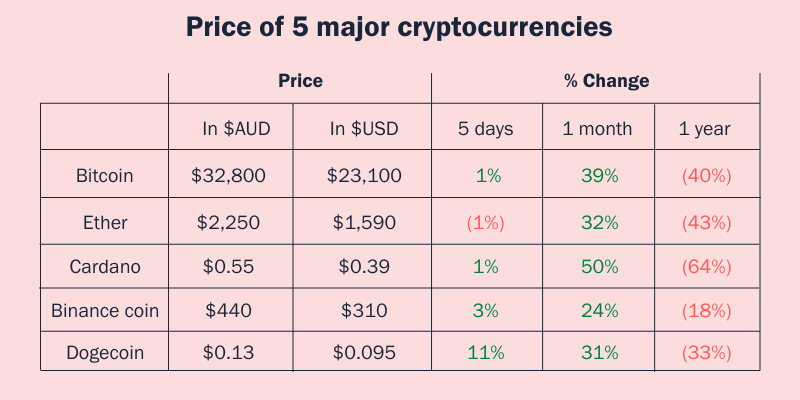

Prices of Top Cryptocurrencies

Tweets & Charts of the week

Articles & Videos

E-commerce giant Amazon is set to shake up the NFT market with its rumoured launch of a digital assets enterprise. This spring, the company is expected to launch the initiative, focusing on non-fungible tokens and Web3 gaming, as reported by Blockworks.

Opinion: The once-burgeoning realm of crypto and decentralised finance keeps imploding, presenting policymakers with a quandary: Should they just let it burn, or step in to address its now obvious flaws? Here is the case for why crypto needs more regulation.

In mid January, Coinbase laid off another 20% of its total employees. The cuts at the cryptocurrency exchange come after nearly a fifth of employees were let go in June, as crypto markets teeter and tech companies rethink their growth plans.

By any measure, 2022 was a terrible year for crypto. In all, more than $2 trillion in largely speculative market value evaporated. The World Economic Forum held its annual meeting in January and here is what they said the future holds for cryptocurrencies…

A quick meme break

Back to it

January was a tough month for crypto companies and their employees. at least 14 firms announced staff reductions, including Coinbase, Gemini, Digital Currency Group, ConsenSys and Blockchain.com. Nearly 3,00 staff were cut in total.

There is an Australian link from Immutable X and FTX that has recently been discovered. A Cayman Islands foundation linked to Immutable had loaned Alameda 10 million digital tokens, variously valued between $US800,000 ($1.1 million) and $US1 million. Could that be an issue for Immutable X?

The UK government is announcing new measures to regulate the crypto industry. It says the proposals, being published this week, will give consumers confidence while allowing the sector to “thrive”. Here’s what you can expect.

Crypto mergers and acquisitions were up last year despite the value of such transactions falling significantly, as increased activity by non-crypto firms looking to get more involved in the segment could signal even more deals going forward. Deal count in the segment was 204 in 2022, according to a report by advisory firm Architect Partners — an all-time high and up 13%from 181 during the prior year. But the value of all crypto M&A deals fell by 64% year over year, from roughly $6 billion in 2021 to about $2 billion last year.

And another

In Focus: 2023 predictions

We all know predictions probably don’t help us, but they’re pretty fun to read…

Here are a bunch of predictions from experts on what will happen with crypto in 2023.

[Read the article here]

Some more of our favourite content

This is an excerpt from our Crypto Newsletter email. Once a week, for those investing in crypto or interested in learning more about this corner of the market, we’re featuring some of the most interesting content we’ve come across in this weekly email. No spam, we guarantee.