This is an article sure to elicit controversy given most people reading it will own shares in these large Australian companies either directly, through index ETFs or through their Super. But if we don’t engage with ideas we don’t agree with, then are we really challenging ourselves and our positions.

The article is focused on the record profits we’ve seen from some of Australia’s largest companies, including record annual profits from Qantas, Commonwealth Bank and ANZ. It argues that high levels of profit are concentrated in industries with weaker competition in Australia – travel, supermarkets and banking – and that is a sign of these companies profiteering in the inflationary environment (basically, the argument is, they are raising prices faster than their costs to increase their profits).

There is arguments on both sides of this. There is no doubt that many of Australia’s largest companies are facing cost-push inflation from higher energy and food prices overseas, the banks are facing higher funding costs and all of this has been exacerbated by the weak Australian dollar which further imports inflation. But more recently, there are signs that many of the inflationary pressures are coming from right here at home.

New RBA Governor, Michelle Bullock, recently gave a speech and made clear that we can’t keep blaming overseas forces for Australia’s rate of inflation.

- “The remaining inflation challenge we are dealing with is increasingly homegrown and demand driven”

- “Hairdressers and dentists, dining out, sporting and other recreational activities – the prices of all these services are rising strongly”

- “If we look across the CPI basket, around two-thirds of items have inflation running above 3 per cent – indeed, often a long way above that number”

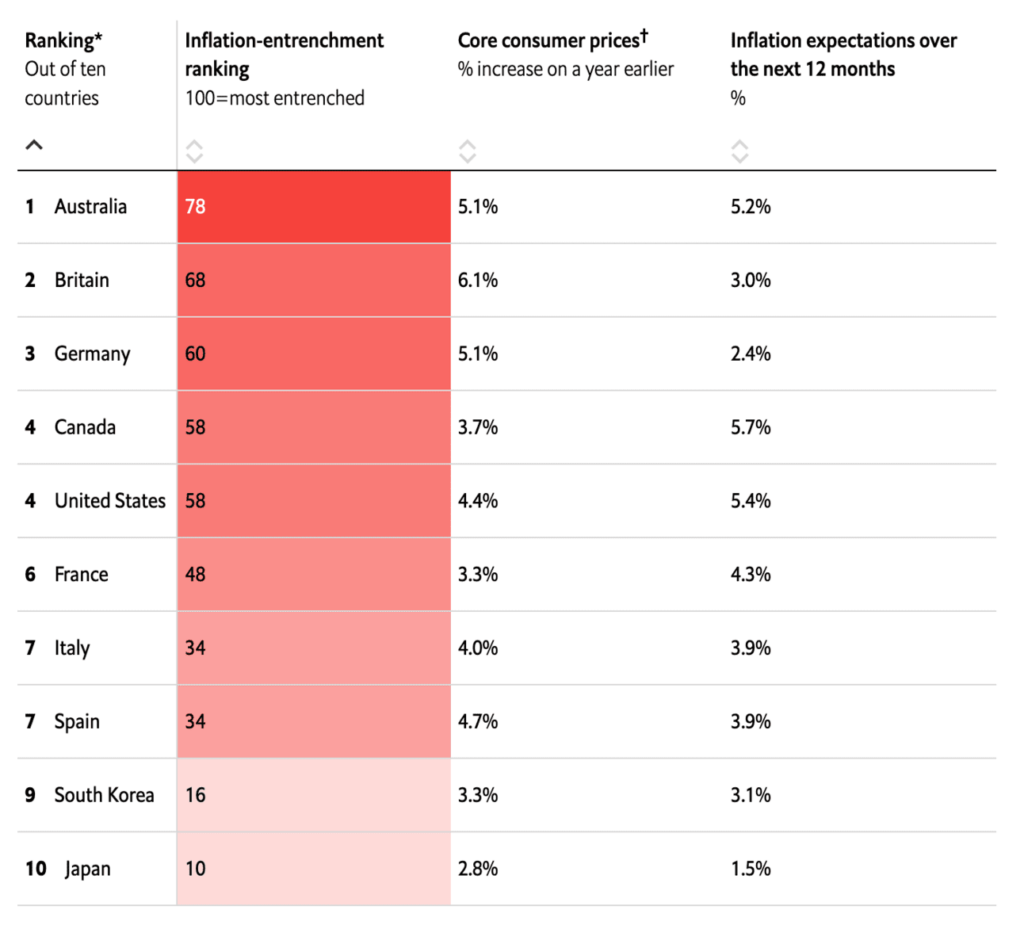

Supporting Bullock’s argument, The Economist recently published an ‘Inflation Entrenchment Index’ that ranks countries on how sticky inflation is within their domestic economy. Australia is #1, with a meaningful gap to second place.

All of this is to say, we are going to need to look more and more at the pricing decisions of Australian companies if inflation remains entrenched. In a world where inflation in the United States fell from 3.7% (12 months to September) to 3.2% (12 months to October) and in the UK fell from 6.7% to 4.6% in the same timeframe, if inflation is truly being driven by overseas forces, we’d expect to see a similar fall here at home.

Australian businesses and government (and in particular policies around the housing and rental market) will be in focus if Australia’s inflation rate of 5.4% (12 months to September) doesn’t fall in a similar manner.

This is an excerpt from our Thought Starters email. Once a week we send you 5 interesting articles that have caught our attention, to get you thinking. No spam, we guarantee.