Ever since President Biden appointed Lina Kahn to run the Federal Trade Commission, we knew this was coming. The US Government is coming for Amazon. Prior to being sworn in as the Chair of the FTC in 2021, Kahn was a noted critic of Amazon while Associate Professor of Law at Columbia Law School. Before that, as a student at Yale Law School, Kahn wrote an essay that has become famous in competition law circles, ‘Amazon’s Antitrust Paradox’.

Biden’s appointment of Khan to head up the FTC was a clear sign: antitrust enforcement of big tech generally, and Amazon specifically, was coming. And on the 26th of September, Khan’s FTC alongside 17 American states filed suit against Amazon, claiming the online retail giant has illegally maintained monopoly power. If this suit is successful, Khan may get her wish and force Amazon to break up.

There have been plenty of explainers written on the legal case and what may happen next (here’s a good one from Vox). However, the article we are featuring in today’s email looks at the business side of the Amazon lawsuit. The author makes the case that to truly understand Amazon, we need to think of it in the same way we think of a social media company.

The classic explanation given about any free tech product is ‘if you’re not paying for it, you’re the customer’. A platform like Facebook amassed 1 billion users and then sells our attention to advertisers. We are the product. Amazon has done something similar. It has amassed hundreds of millions of customers, but we as customers are not profitable for Amazon (take for example, Amazon Prime costs $139 per year in the US, but according to one JP Morgan analysis costs the company over $1,000 in free shipping). Amazon has used their low margin business model to aggregate customers and become the dominant eCommerce platform.

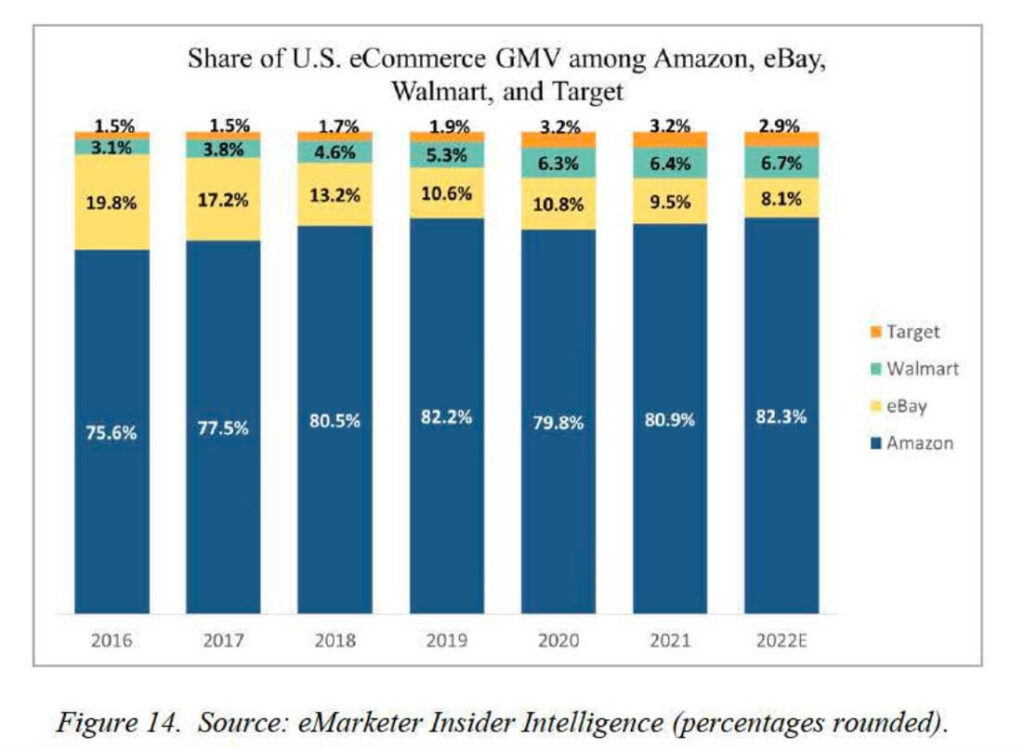

Amazon then sells access to us, their hundreds of millions of customers, to third-party sellers. Costs charged to third-party sellers now make up almost 50% of Amazon’s revenue. As a third-party seller you are charged listing fees, warehouse fees and often need to pay for advertising to appear high in the search results.

“Advertised products on Amazon are 46 times more likely to be clicked on when compared with products that are not advertised.”

FTC’s complaint against Amazon

According to the FTC, this is where Amazon’s anticompetitive actions begin. It alleges that to protect it’s dominance and to ensure third-party sellers continue to rely on it, Amazon engaged in all manner of anticompetitive acts. For example, barring all third-party sellers from offering their goods for lower prices anywhere else online.

We’re in antitrust season in the US. Between the Google antitrust case, Apple’s fight with Epic Games potentially going to the Supreme Court and now Amazon’s antitrust case, we’re going to see a lot of developments over the coming months. The outcomes of these cases will play a large part in determining the future of Big Tech and perhaps, whether they will remain Big at all.

This is an excerpt from our Thought Starters email. Once a week we send you 5 interesting articles that have caught our attention, to get you thinking. No spam, we guarantee.