After Australia, Chile is the world’s second largest producer of lithium. And an announcement last week by President Gabriel Boric indicates there are major changes coming for Chile’s lithium industry. Boric plans to nationalise the industry and transfer the assets of lithium giants SQM and Albemarle to a new, state-owned company.

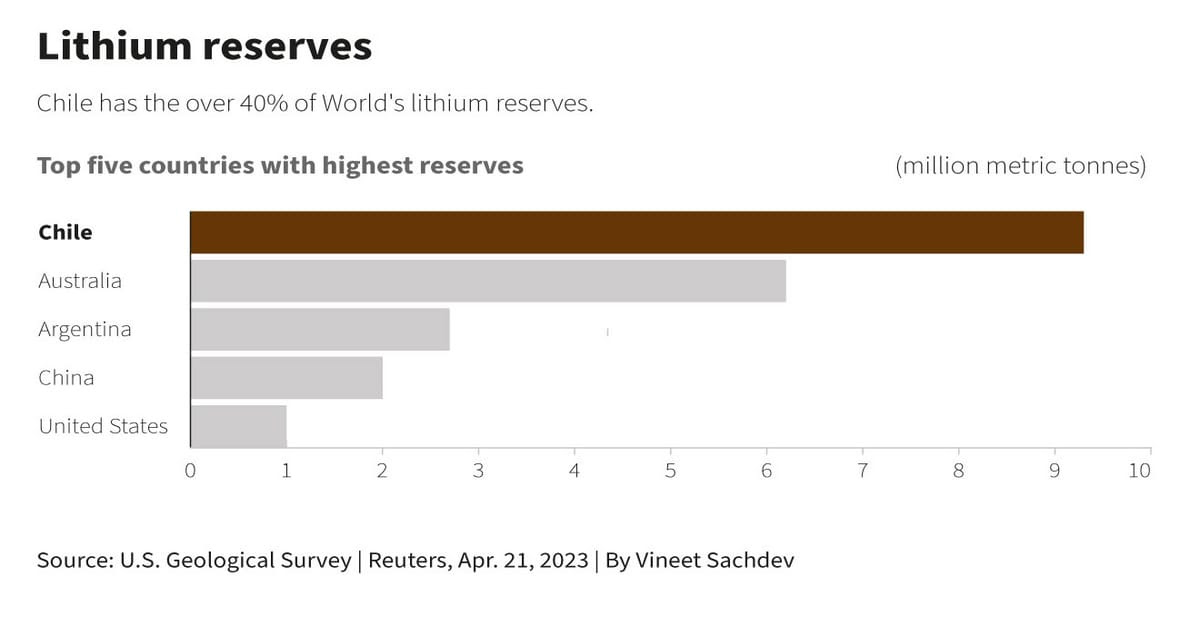

While Chile may be the second largest producer of lithium, it has the world’s largest known reserves of the metal. And electric vehicle makers and renewable energy generators were hoping Chilean miners would be finding ways to extract more of the metal to keep up with demand. Now that will be up to Chile’s new state-owned company.

This isn’t new for Chile. The country already operates the world’s largest copper producer, state-owned Codelco. Meanwhile, analysts expect this move may benefit countries like Australia, as private investment that was earmarked for Chile will be moved to other countries.

This is an excerpt from our Thought Starters email. Once a week we send you 5 interesting articles that have caught our attention, to get you thinking. No spam, we guarantee.