This recent survey out of American financial services giant Charles Schwab suggests that as interest rates rise an overwhelming number of young people are turning to fixed income. In fact, they found that younger investors are adopting fixed income investments at a faster rate than older investors (who would naturally be more interested in lower-risk, income paying investment options).

The Schwab data found that millennials have as much as 45% of their portfolios in fixed income investments such as bonds, compared to 31% for Baby Boomers and 37% for Gen X. Similarly, 51% of Millennials said they planned to invest in a fixed income ETF in 2024, compared to 40% for Baby Boomers and 45% for Gen X.

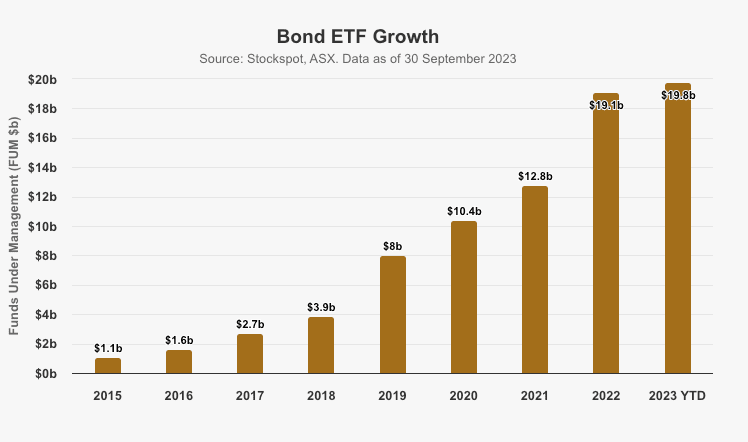

For the first time in many Millennials’ investing lifetimes, fixed income investments make sense in a portfolio. When fixed income starts paying 6, 7 or even 8%, it starts to become an enticing alternative to stocks and property. And this has been reflected in the increasing assets under management in Australian bond ETFs.

However, there is an important watch out for anyone thinking about fixed income. It is a big investing universe, and plenty of investment options are still paying well below inflation.

Take Australia’s two largest fixed income ETFs: iShares Core Composite Bond ETF (IAF) and Vanguard Australia Fixed Income Index (VAF). The 12 month trailing yield (i.e. what an investor would’ve received if they’d held the investment for the past year) on the iShares Core Composite Bond ETF is just 1.6%. Similarly, for the Vanguard Australia Fixed Income Index it was a little over 1%.

So when looking for fixed income options, make sure you’re looking under the hood and considering what income products are right for you. And if you’re stuck in an investment that is earning less than 2% a year, it’s important to remember that you can find high interest savings accounts that are paying more than double that today.

This is an excerpt from our Thought Starters email. Once a week we send you 5 interesting articles that have caught our attention, to get you thinking. No spam, we guarantee.