A few weeks ago, on Equity Mates Investing Podcast, we celebrated Bryce taking the plunge and buying a house. Ironically, that same day we read a report from an analyst based in Singapore titled ‘Australia’s coming housing bust’.

We spoke about it on the podcast and shared some of the charts on Instagram, but here we are sharing the full article for those interested in reading.

For Australians, this is a story that has been well told. But we found it interesting to read from an outsiders perspective.

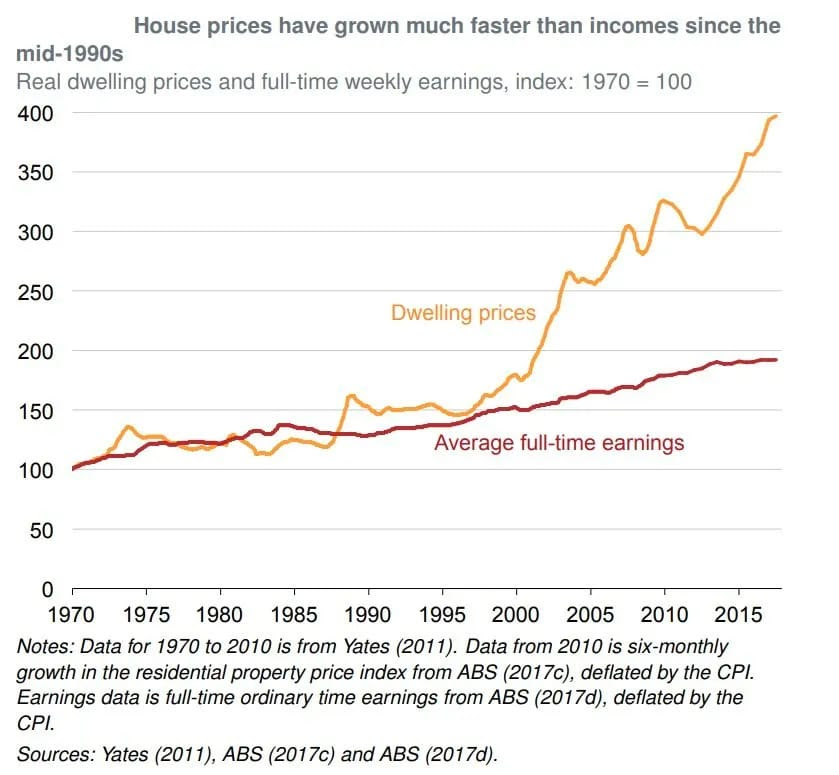

- Historically, house price growth has tracked wage growth

- Since the 2000’s, government policy has driven up the price of houses

- Australians were forced to borrow more and more, even as housing became unaffordable by all traditional measures

- This borrowing was sustainable as long as interest rates continued declining

- Now that interest rates are rising, we’re seeing mortgage stress

Nothing we post across Equity Mates gets nearly as heated a reaction as housing posts. And one key element that the author of this report seems to miss is the net overseas migration numbers. With 400,000 new residents in 2022-23 and another 300,000 forecast for 2023-24, many housing experts believe that will create demand and keep prices rising. Especially because at our best, Australia is only able to build a bit shy of 200,000 new houses each year.

However, this short-term bump from migration doesn’t change the longer term story. House prices have become completely divorced from the broader economy. This chart that shows how house prices tracked earnings until the turn of the century really sums it up.

All of this isn’t to say that a crash is inevitable. We could see the market propped up for years or decades to come with new government policies and a growing population. Or we could see the market trade sideways as it allows earnings to catch up.

At the end of the day, the reality is that the Australian housing market is one of the most unaffordable in the world. It is important to remind ourselves that hasn’t always been the case and it isn’t inevitable that it will remain so. Over the long term, financial markets have a habit of reverting to the mean.

This is an excerpt from our Thought Starters email. Once a week we send you 5 interesting articles that have caught our attention, to get you thinking. No spam, we guarantee.